We continue our series on All About Credit with this important piece on protecting your credit, which again, we will divide into 2 parts. Let’s start with Part 1. The video presentation is below.

Forms of Identity theft

There are many forms of identity theft and almost all of them affect your finances in one way or another- thereby also putting your credit at risk.

People often go very long without knowing they’ve been fraud victims. Here are some clues to monitor:

- Credit card charges you don’t recognize- often these charges are small to begin with and may skip your radar unless you regularly comb through each charge on your statement.

- Inaccuracies in your Credit Report- like accounts you don’t recognize

- An unexpected medical or pharmacy bill

- A collection agency debt you don’t recognize

- Notice from IRS that more than 1 tax return was filed w your SSN

- Bank accounts with vanishing money

- Government benefits get inexplicably denied

- Issues with law enforcement- parking tickets, Driver’s License suspensions, arrest warrants: all for crimes you didn’t commit

First-line Measures to Protect Your Credit

- Employ common sense measures when online- clear logins and passwords, use strong passwords, change passwords frequently, be aware of phishing techniques.

- Check your bank accounts and credit card activity weekly- monthly may not be often enough.

- Shred sensitive information- even unsolicited mail offers may have personal information. One useful hack is to keep your shredder right next to where you sort your mail.

- Monitor credit report for inaccurate account information or inquiries. Stagger them out over the course of the year so you stay abreast of changes.

- Check if your employer provides ID theft insurance.

- Check what protections your bank or financial institution has in place- what it includes & what it doesn’t

Second-Line Measures To Protect Your Credit

- Set up Fraud Alerts

- Freeze your credit

- Employ Credit Monitoring Services

Fraud Alert

Having a fraud alert in place requires creditors to take additional measures to verify your identity before issuing you new credit, thereby creating a deterrent for ID thieves.

You can place the alert at any one of the credit bureaus, which must then inform the other two.

This service is provided by the Credit Bureaus at no cost to you.

The initial alert stays active for 90 days; it needs to be renewed if you would like it to continue. You can also remove it at any time.

You get a free Credit Report from each Bureau when you place the initial alert and each time you renew.

Victims of identity theft can place an extended fraud alert which stays in place for 7 years. This actually requires proof of the identity theft incident.

Credit Freeze

Credit Freeze is a step-up from Fraud Alert.

As the name indicates, it is a complete freeze on your credit file- which means neither you nor someone pretending to be you can open a new line of credit in your name.

Businesses that you have an ongoing relationship with will still have access to your credit report, so it does not affect current accounts.

You need to do this separately at each Credit Bureau. Until recently, there was a nominal fee to do so- but in May 2018, Congress made it free to place, lift or permanently remove a credit freeze in all states.

You are given a PIN- which you need to unfreeze/refreeze at a later date- so keep it safe.

Every time you need a new loan or credit card, you will need to temporarily lift the freeze.

Point to note, though- this does not prevent ID theft on your existing credit cards- so you still need to stay alert on card activity.

You can also continue to monitor your Credit Reports while the freeze is on.

A credit freeze is not bulletproof protection- at the Equifax breach in 2017- PIN data of customers were stolen- rendering even frozen credit susceptible.

You can have a Fraud Alert and a Credit Freeze on at the same time- though some will say this is overkill.

Neither of these measures negatively impacts your Credit Scores.

Credit Monitoring Services

We will begin this here and finish up in the second part of this series. Credit Monitoring Services may be free or paid for.

DIY Credit Monitoring

Where you do the legwork and get to keep your money.

- We have talked in earlier presentations how you are entitled to one free Credit Report per Credit Bureau per year at AnnualCreditReport.com.

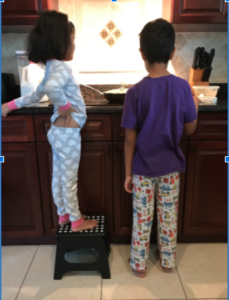

- Most credit card companies monitor your card for suspicious activity- and their security algorithms are constantly getting better. They are able to flag an out-of-ordinary activity almost immediately. I had a call from my card issuer within minutes of them detecting my card being used at a pub- where I had never been- on a Saturday morning. Their algorithm probably knows that I am in my jammies making pancakes with the kids around that time on the weekends. After all, they have incentive to do so. Since with today’s zero liability policies, they are on the hook to pay up.

- Most major credit cards also offer regularly updated Credit Scores for free. As a perk to consumers. It is generally a 1 Bureau score- the one they use to monitor your credit. So, with the right mix of cards, you may be able to monitor your scores from all 3 Bureaus.

Apart from these, many websites will give you free access to your score- more commonly VantageScore. Likely in return for free registration on the site and further promotional offers. If you’re willing to put up with that, these may work just fine.

Together, these make up your DIY credit monitoring service.

To be continued in Part 2 of the series. Thanks for reading! I would to love to hear from you- please do comment below.