I was late to the FBAR party. I did not even know there was such a thing. And none of the *fabulous* CPAs who did our taxes for the first decade and a half of our lives in the U.S. told us about it. So, if you have any foreign accounts, you need to file the Foreign Bank and Financial Accounts (FBAR) every year. Here’s the step-by-step on how to file FBAR.

What is FBAR?

The Bank Secrecy Act gives the Department of Treasury the authority to know if you have any financial interests in a foreign account. They do this by requiring holders of such accounts to annually file a form with the Financial Crimes and Enforcement Network (FinCEN Form 114). This is, in effect, how you report your FBAR.

Who Needs to File FBAR?

Any U.S. individual, trust, estate or company that has any “financial interest in and/or signature or other authority” over any accounts located outside the U.S. needs to file the FBAR, if the holdings within the accounts amount to greater than $10,000 at any time during the year.

These include bank and brokerage accounts, and insurance policies physically located in a foreign country.

Foreign accounts are not just for tycoons trying to hide their money in offshore accounts. Many of us many accounts outside of the U.S. for legitimate reasons. For example, our families live in India. We have bank accounts there for convenience and easy access in case of emergency.

FBAR helps the U.S. government keep a tab on income generated abroad, any illicit activity with said accounts, and folks trying to circumvent laws or evade taxes.

What is “Financial Interest”?

A U.S. person is said to have financial interest in an account if:

- They are the account holder- whether or not the funds in the account are for their benefit

- Someone else is the account holder but acts of behalf of this U.S. person

- A U.S. person owns at least 50% of the entity (corporation/partnership/trust, etc) that holds the account

“Signature authority” over an account means that a U.S. person has the authority to move funds out of the account, even if not for their benefit. So, if someone has power of attorney over their elderly parents’ bank accounts. Or an official/employee of a company has that authority over the company’s accounts abroad, they have signature authority over the account and must file FBAR annually.

How to File FBAR

- FBAR is not part of your annual tax filing. You file it separately on the BSA’s e-filing system.

- The due date for FBAR is April 15 of the following year- just like the rest of your tax returns. However, there is an automatic extension till October 15, without needing to file an extension for it.

- A spouse may not need to file an FBAR if all accounts are held jointly with the other spouse- and she/he is filing for the year.

Steps to File FBAR

To file your FBAR, go through Google or directly to BSA’s E-Filing System.

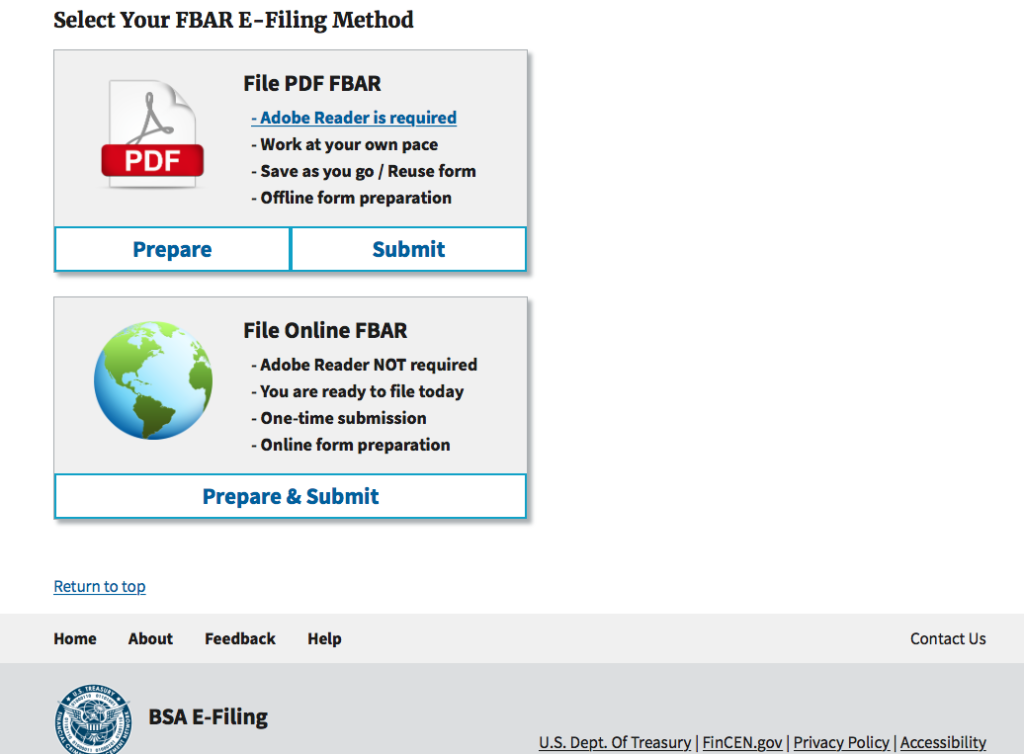

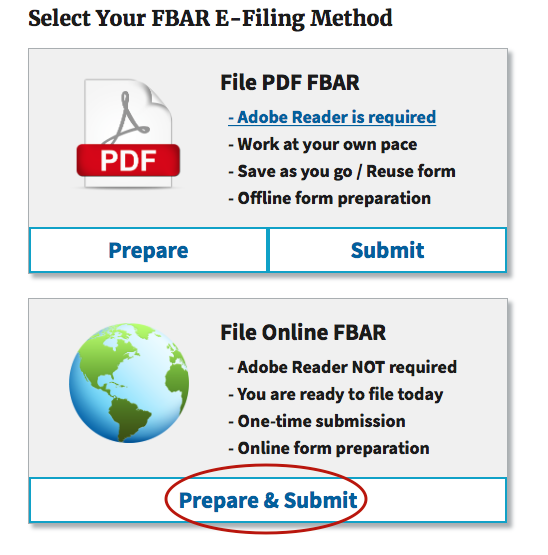

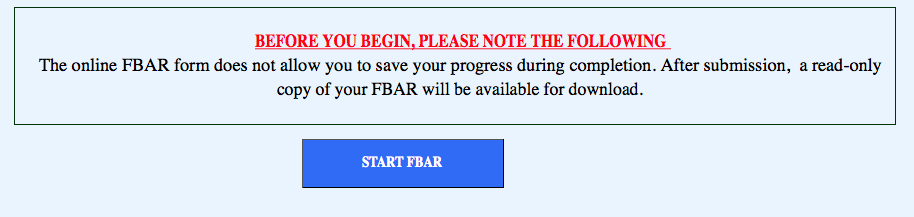

This is how the landing page looks.

You have an option to file on paper. But I can’t think of a reason why. The online filing is super easy and takes only a few minutes if you have the information handy.

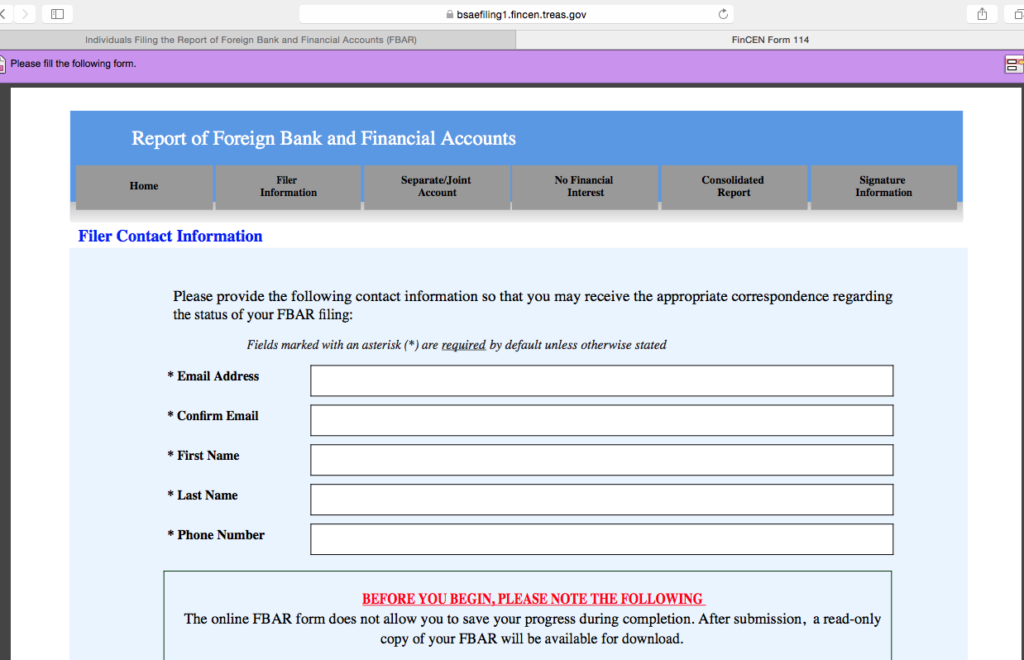

You start with your contact information: name, email address and phone number.

You do have to complete the form in one sitting- there is no way to save your progress. But unless your situation is very complex, it does not take long to complete the form.

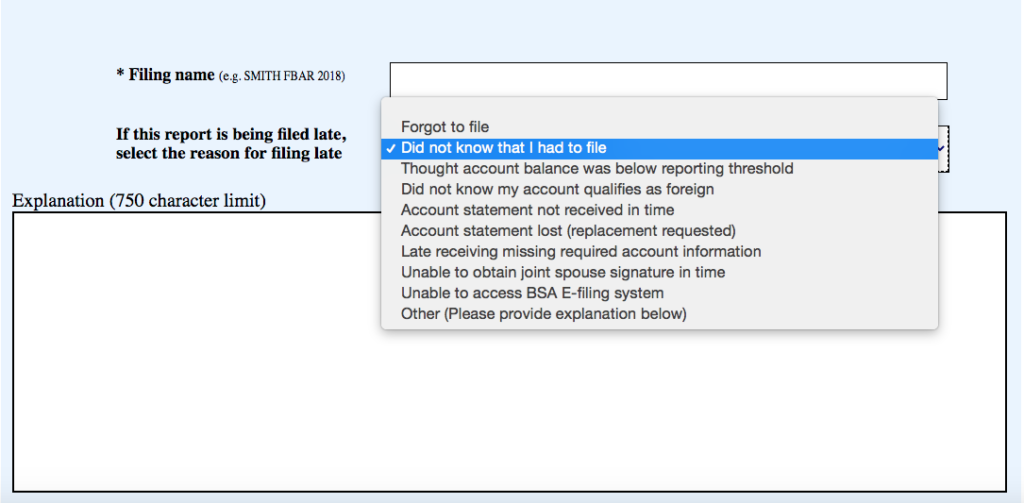

Filing a Late FBAR

Like I said in the beginning, I didn’t even know I’m supposed to file an FBAR every year. So, a few years back, when I found out, I belatedly filed for all the preceding years that I was required to. In selecting the reason, I chose “Did not know that I had to file”. And the IRS accepted it.

Back to Steps to File FBAR

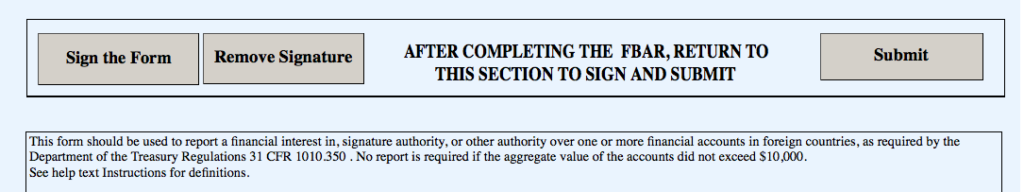

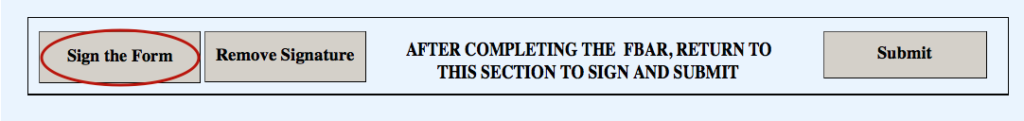

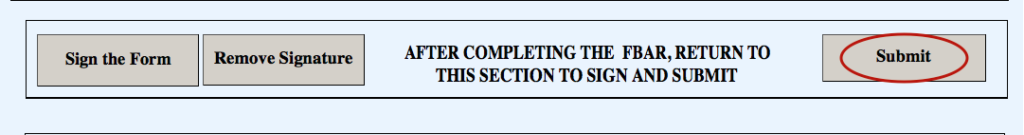

Next you will see the Sign and Submit part of the form that you return to at the very end, after completing it.

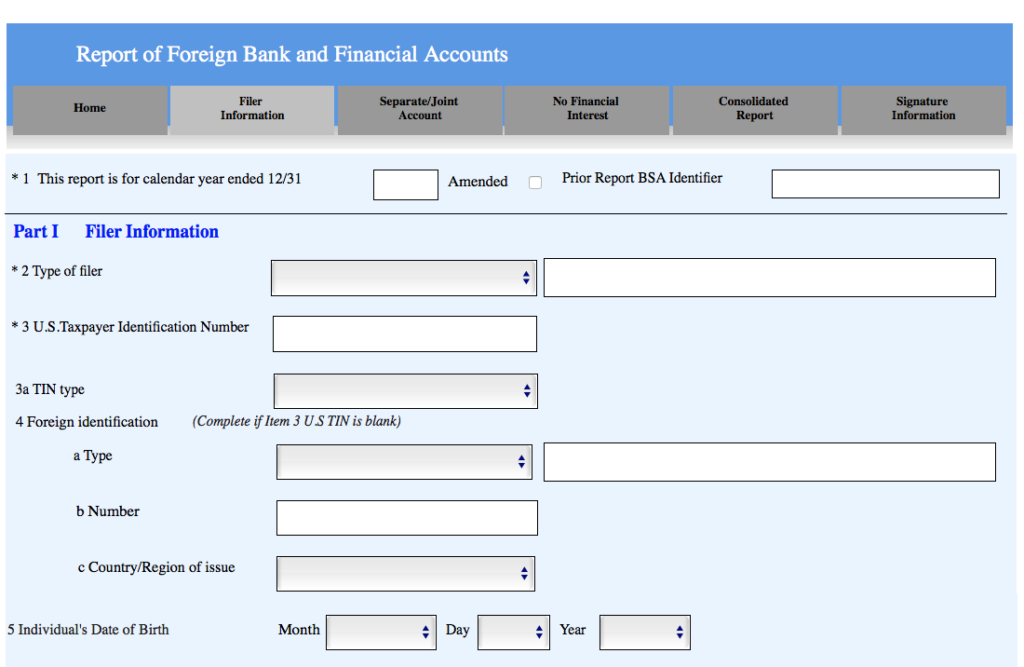

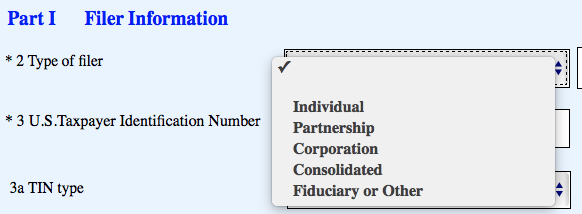

The form starts with your basic personal details such as:

- * SSN

- Date of Birth

Most of us are filing as individuals.

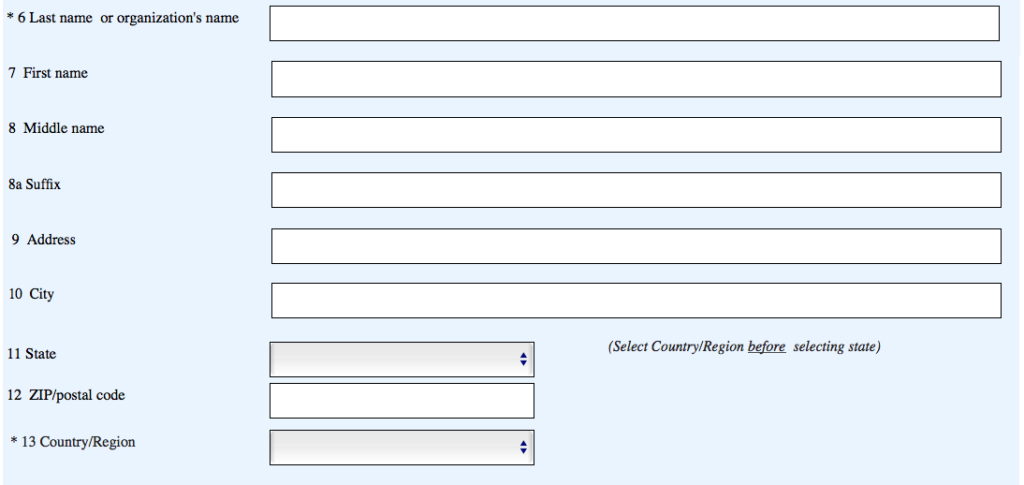

- Name and

- Address

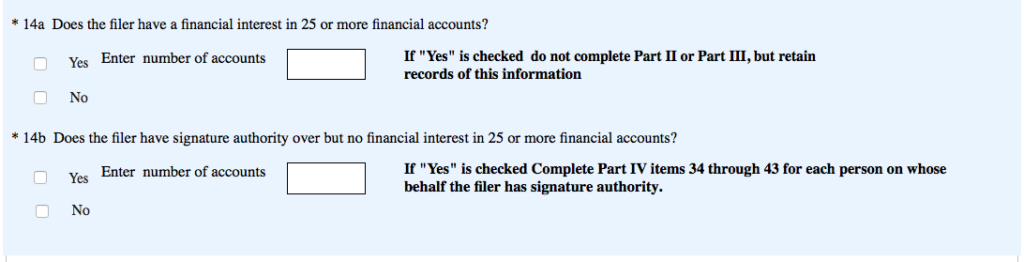

If you have to report more than 25 foreign accounts, you file a Consolidated FBAR. I do not know more about it since I’m not filing one.

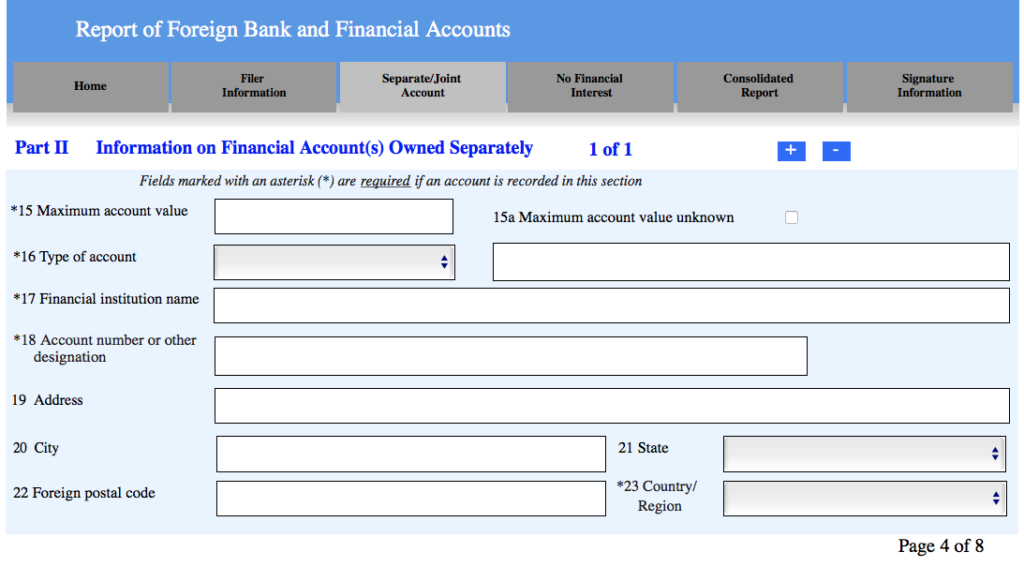

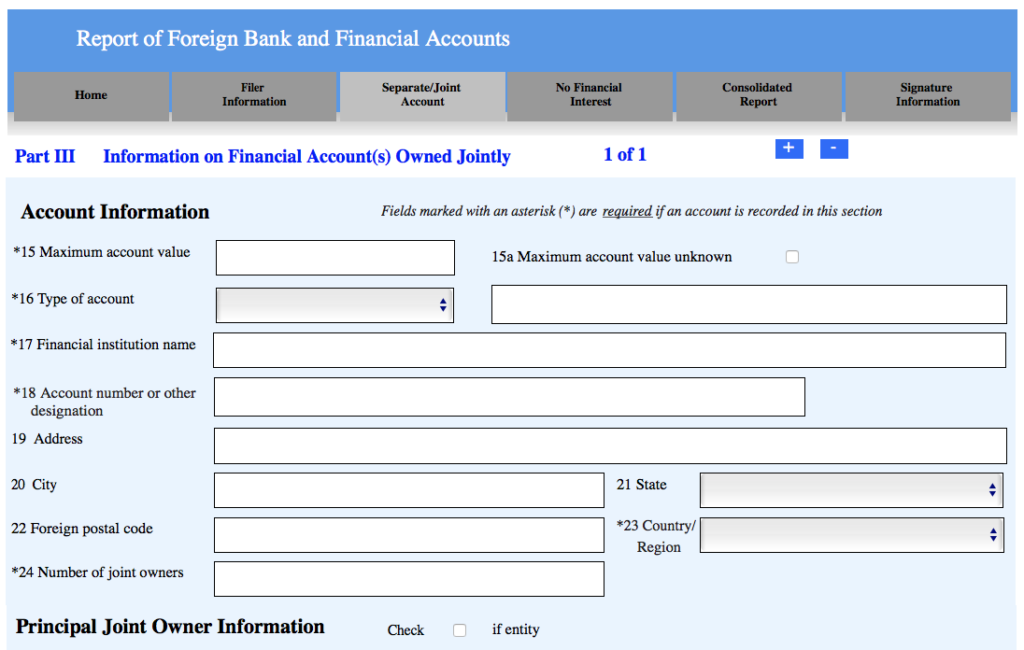

Next comes basics details of the accounts. You fill Part II for accounts you own individually. And Part III for accounts held jointly with someone else- whether or not that person is a U.S. person.

Account details include:

- Maximum account value during that particular year. Say, on September 23rd, 2019, my account had a value of $12,500- which was higher than any other time in the year- you enter that value.

- Type of account

- Name of the Financial Institution

- Address of the Financial Institution

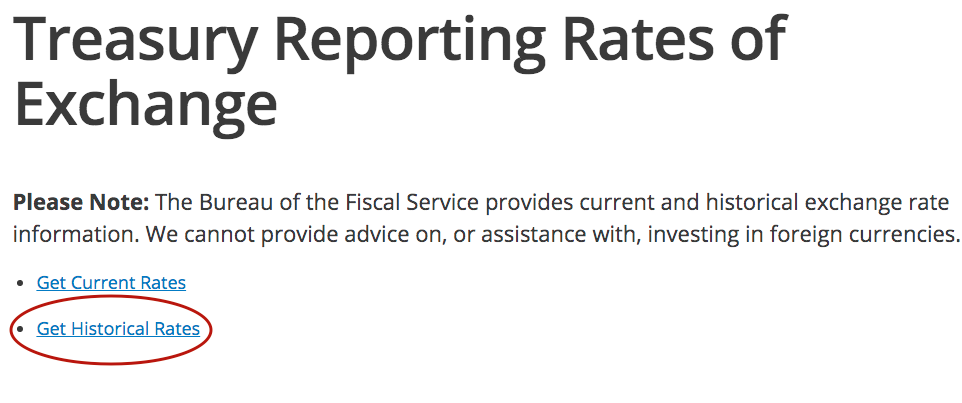

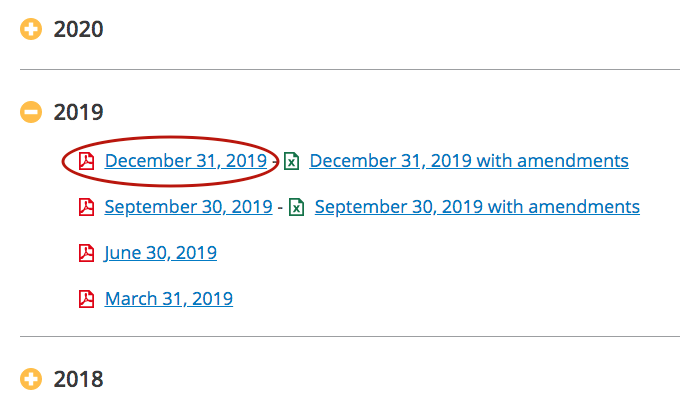

Most accounts in foreign countries report their values in the local currencies. The IRS dictates that you use the Treasury Reporting Rates of Exchange to determine the foreign exchange rate.

Use the Historical Rate from the last day of the year you are filing for. For example, I am filing for 2019, hence I use the rate for December 31, 2019 for the country my account is located in.

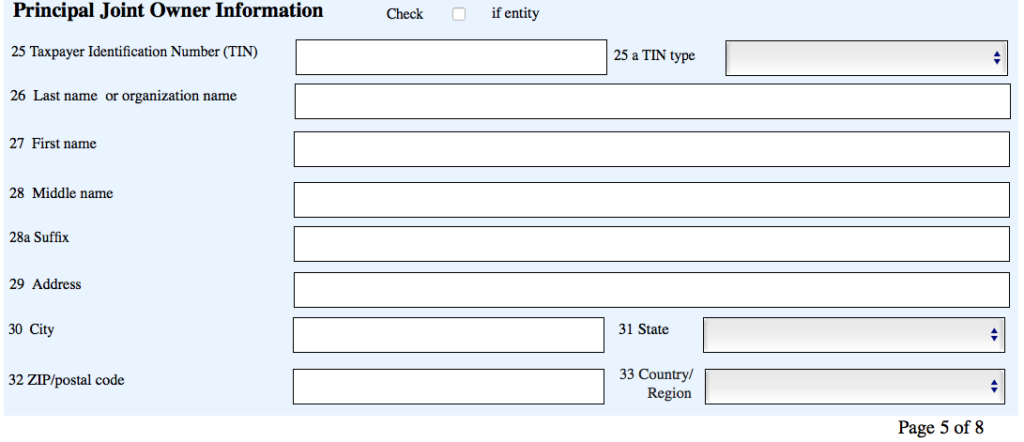

Part III is exactly the same, but for jointly held accounts.

So, you also have to enter the name and address of the joint holder. If they are not a U.S. person, the Tax ID is not relevant.

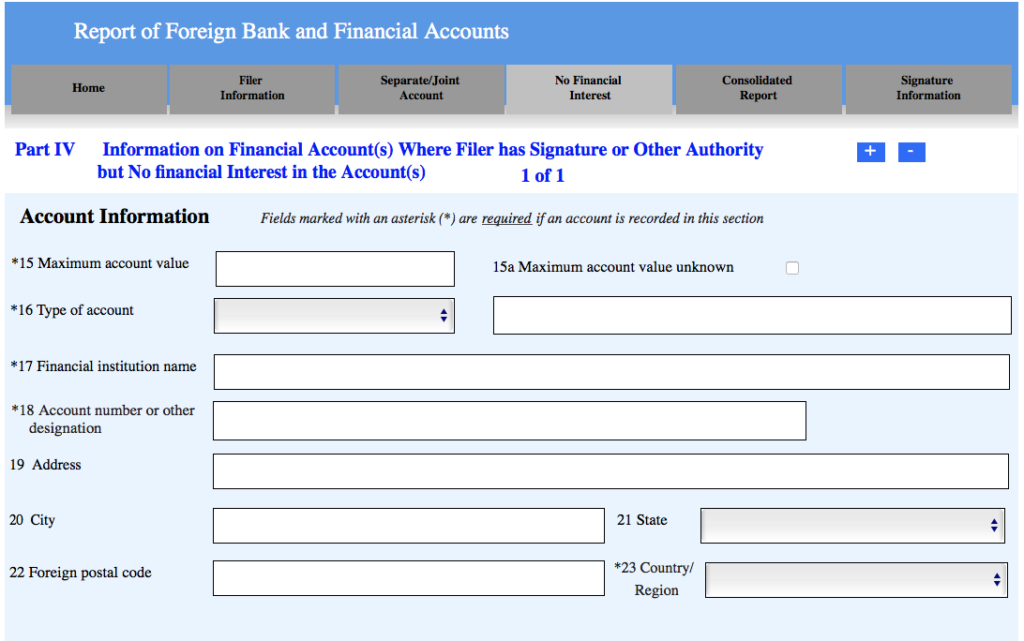

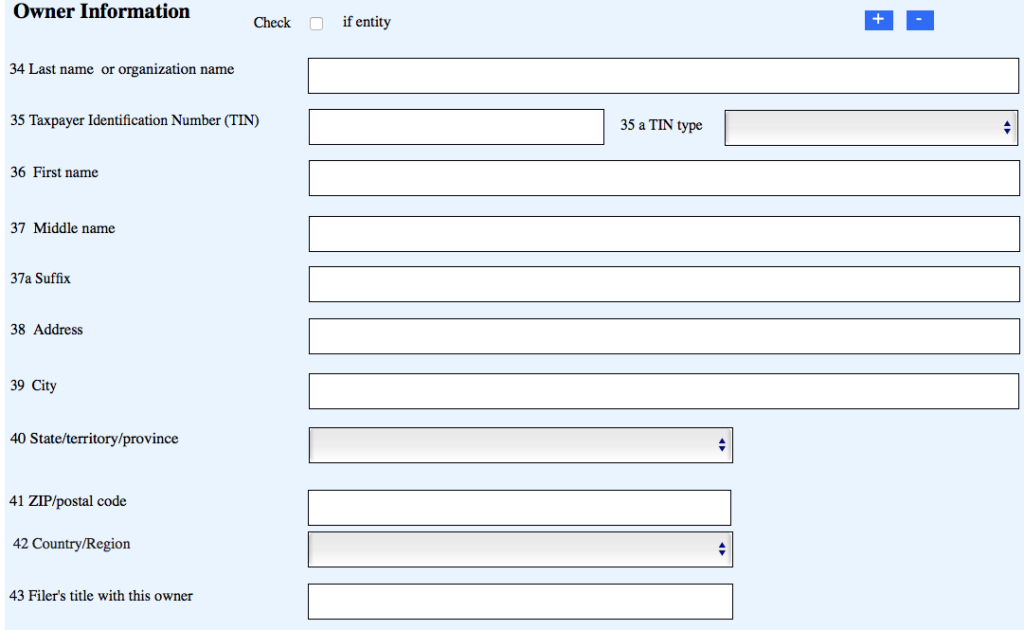

Part IV is for people who only have signature authority over accounts but no financial interest- such as employees of companies who hold foreign accounts.

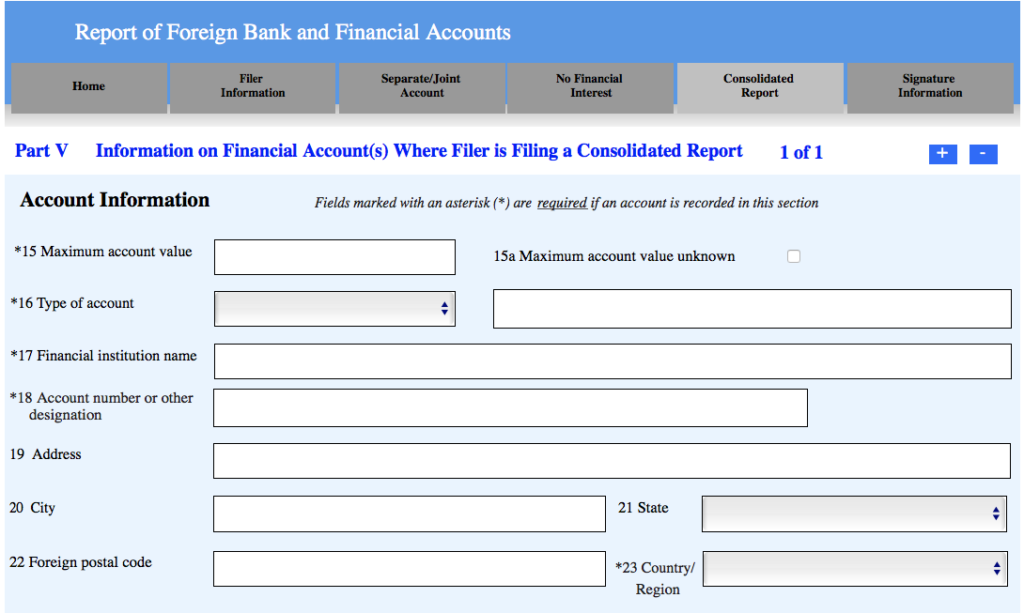

Part V is for Consolidated Reports- when you own 25 or more accounts.

Leave the parts that do not apply to you empty.

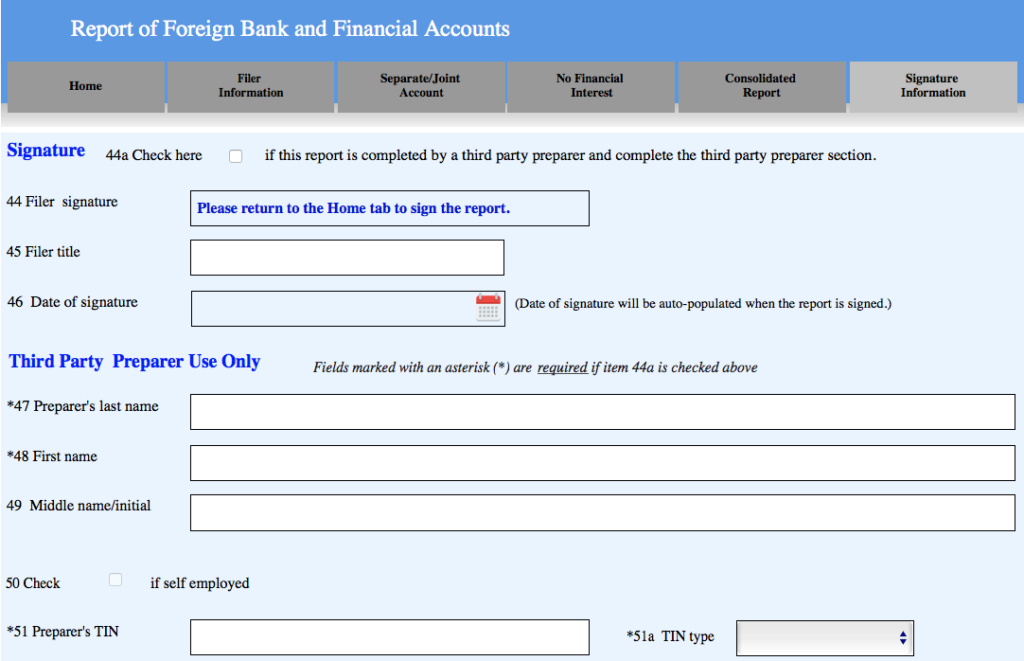

When done, hit the “Back to Home/Sign Form” button.

It will take you back to the beginning.

Once you sign and hit submit, the system states that and also dates it.

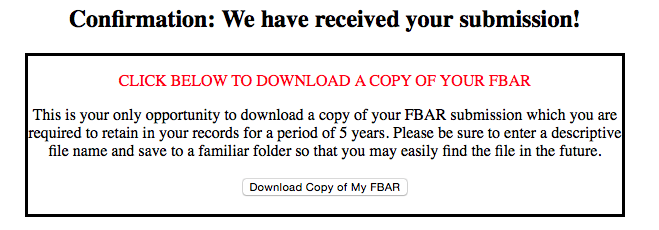

There is a confirmation message. You are requested to download and save a copy of your FBAR.

They recommend you save records for the filing for five years.

That’s all there is to it.

Questions or comments? Do you file an FBAR annually? How has your experience been?