I have two single member LLCs- one for my practice and one for this fun venture. I set them up last year on Florida’s SunBiz.org for $125 apiece and without breaking a sweat. It let me know at the time that I have to file an annual report every year, starting the year after the LLC is formed. So, here are the steps I took on how to file annual report for your LLC. Yours will vary a little bit, if you’re not in the sunshine state but still nothing you can’t do in less than 15 minutes.

What is an Annual Report?

An LLC or partnership has to file a report every year to keep it active with the state’s division of corporation. It confirms basic information about the corporation and lets you make changes to said information. you then pay the fee associated with maintaining your entity with the state for another year.

In Florida, you have until May 1st , after which there is a steep fine. And after September/October, your entity is dissolved if you still have not filed.

This is something your attorney can do for you, if you used one to form your LLC but it’s so easy that you can do it yourself and keep those few hundred bucks.

How to File Annual Report for LLC

I had been dreading the filing. DIY’ing is fun only if you have the time for it. And time’s been in short supply lately. But with the Florida deadline of May 1st approaching, I couldn’t push it any longer. I need not have worried. It’s really simple. They really just want you to say, that, yes, I still want this LLC active and I’ll pay the state for it. That’s it.

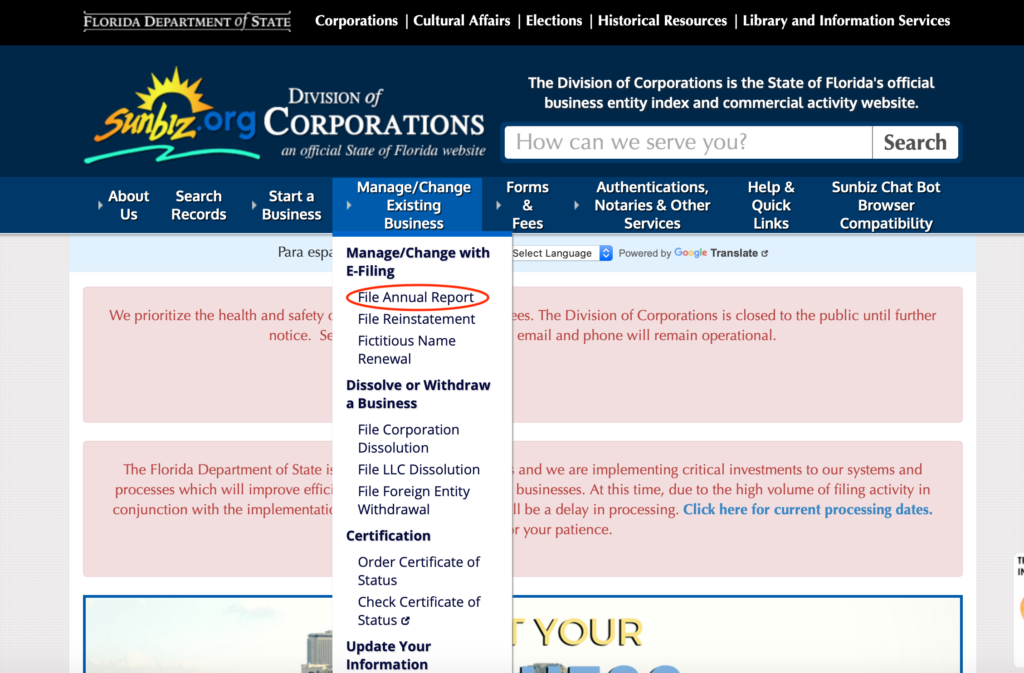

#1 Head over to the state Website

Your state will have some version of a Division of Corporations- likely the same place where you formed the LLC in the first place. You will also get emails reminding you to file the annual report- and it will have links to the website. Florida’s is aptly called Sunbiz.org.

#2 File Annual Report for LLC

Link to file annual report is splashed all over the home page- it’s not hard to find.

#FAQs on Annual Filing

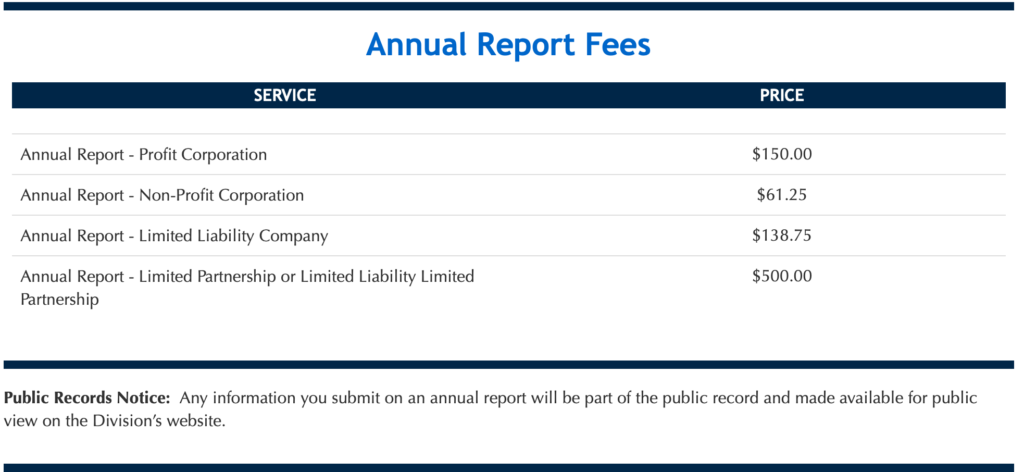

FAQs are conveniently located on the same page and opens up to the following, including tips to help figure out your document/LLC number and payment options.

It also lists the fees. I paid $138 for an LLC, as below.

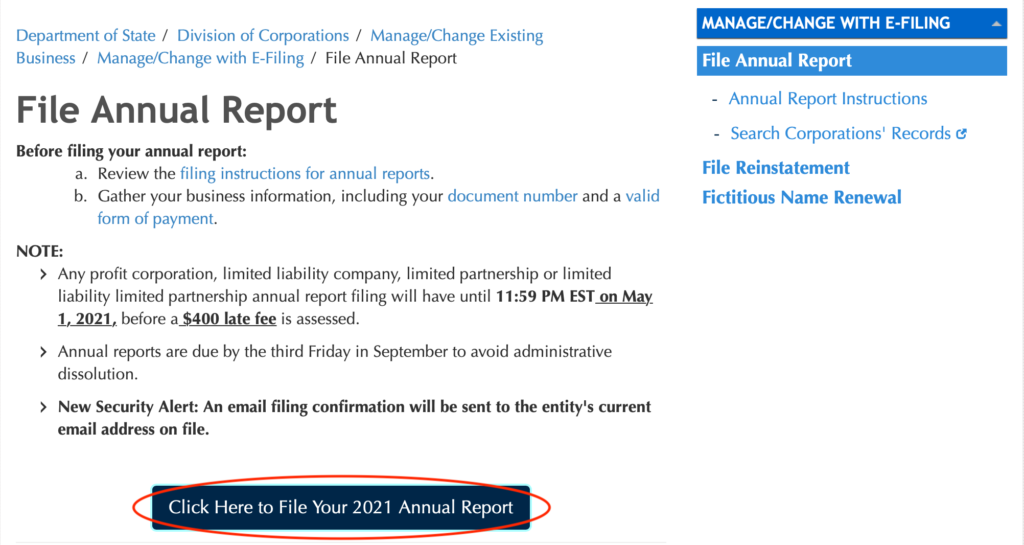

# Ready to File

Hit the button and go.

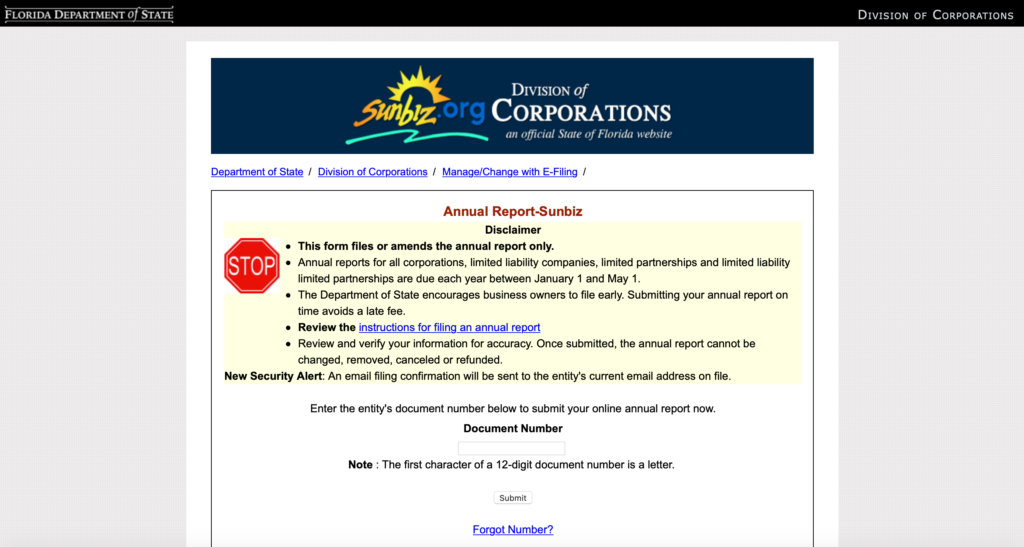

It gives you a warning that you are indeed starting to file, in case you’ve wandered here in error.

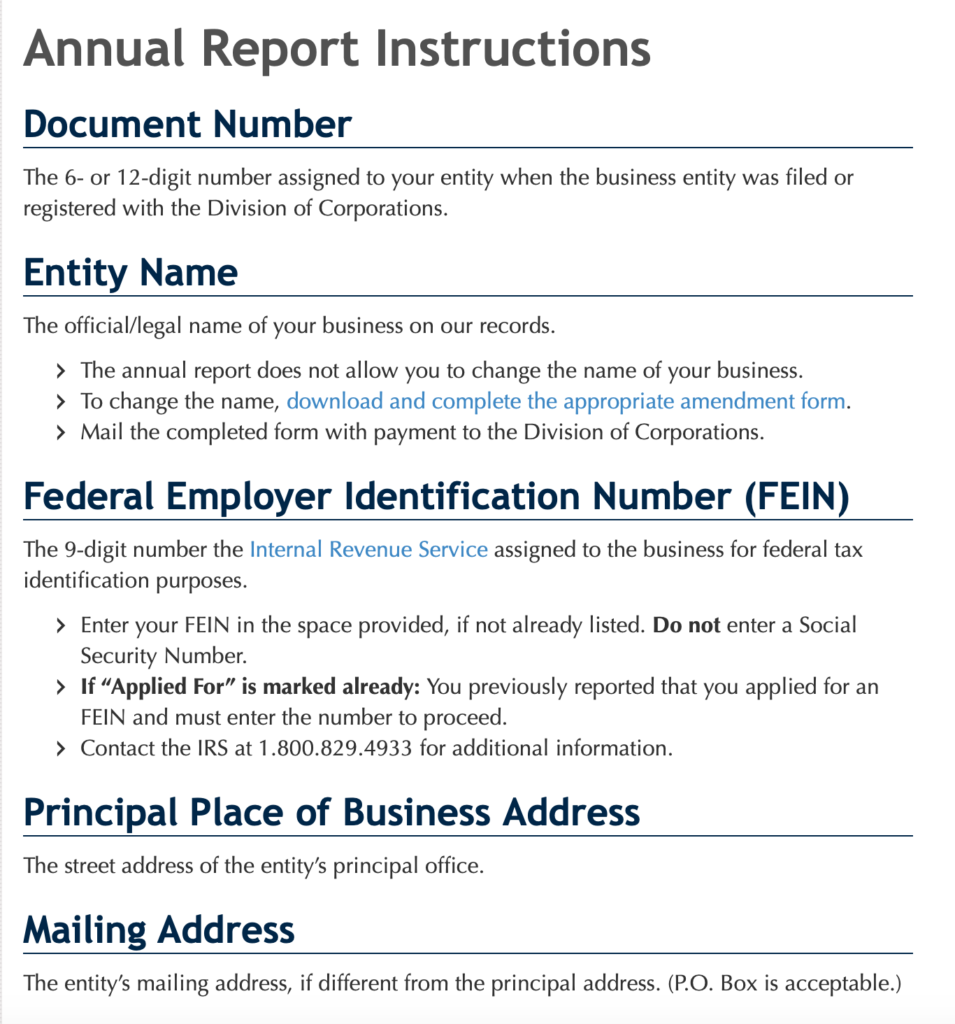

# Instructions for Annual Report

Instructions detail out the entries you will make in the report- so it may be helpful to go through them.

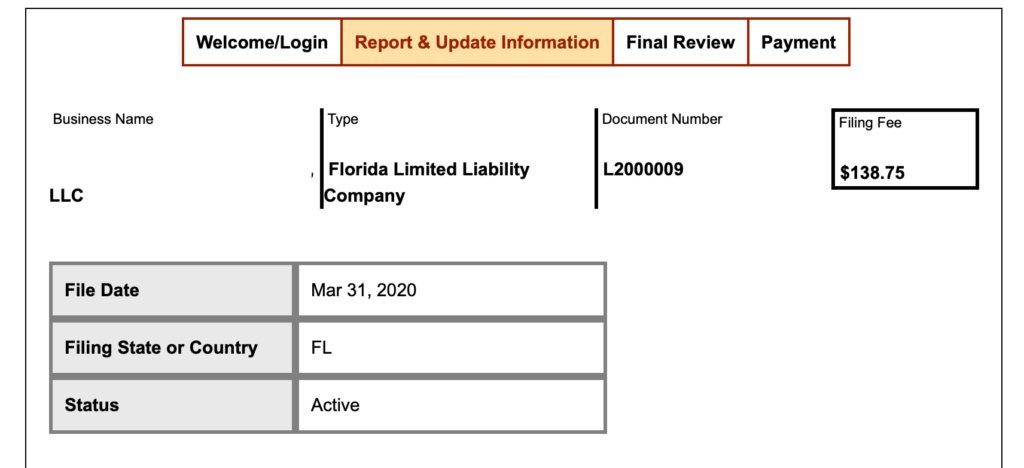

# Review and Update Information

This includes your business name, the document/entity number and the date your entity was filed. I’ve deleted the details in the picture- that is why it looks blank in some places.

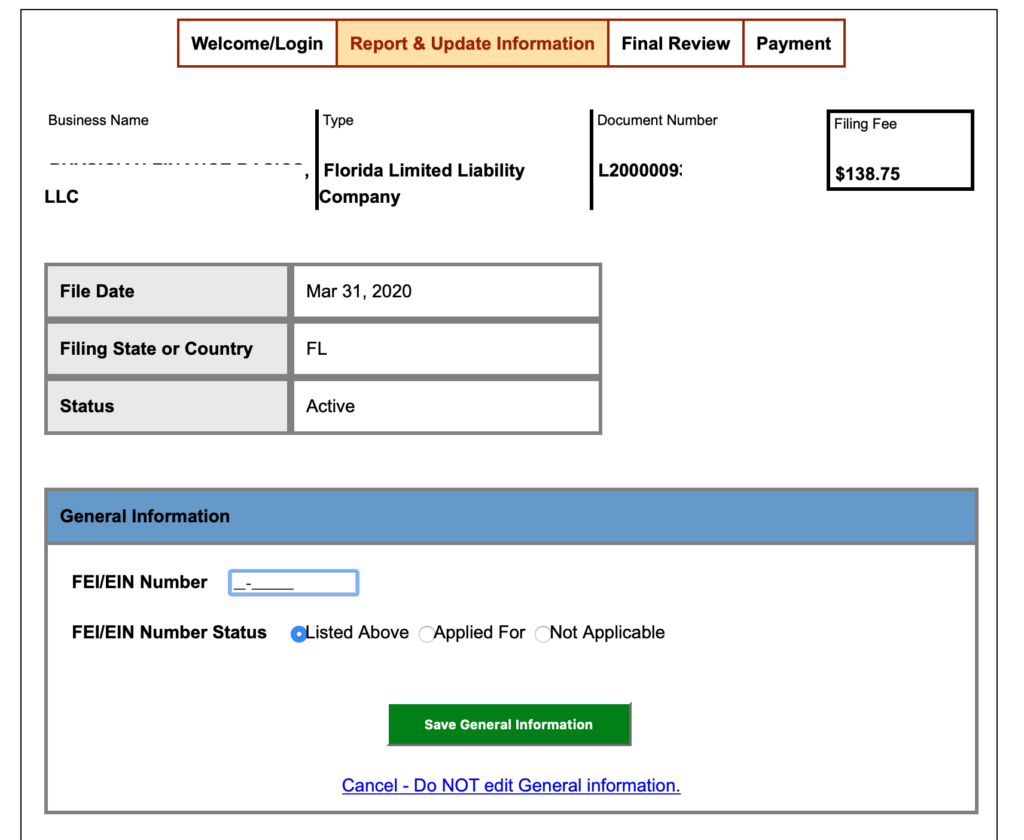

# Confirm EIN

You will need your EIN: hit edit EIN and it will let you enter your EIN.

I am my own registered agent, since I did not use an attorney to form the LLC.

Save the information.

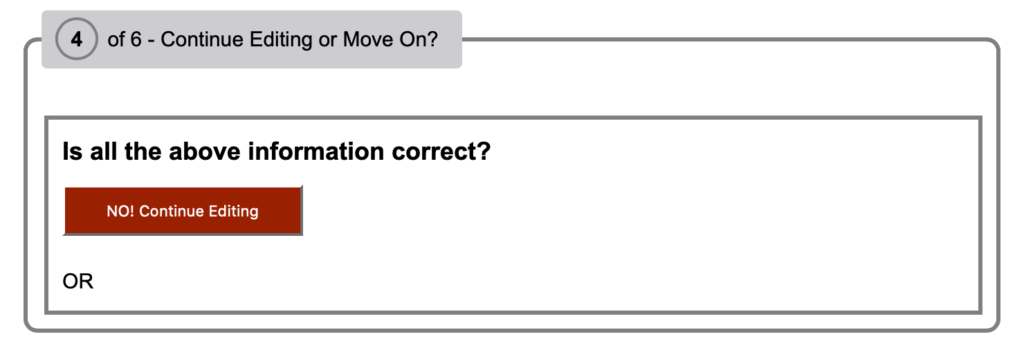

# Review the information

Make sure everything’s right.

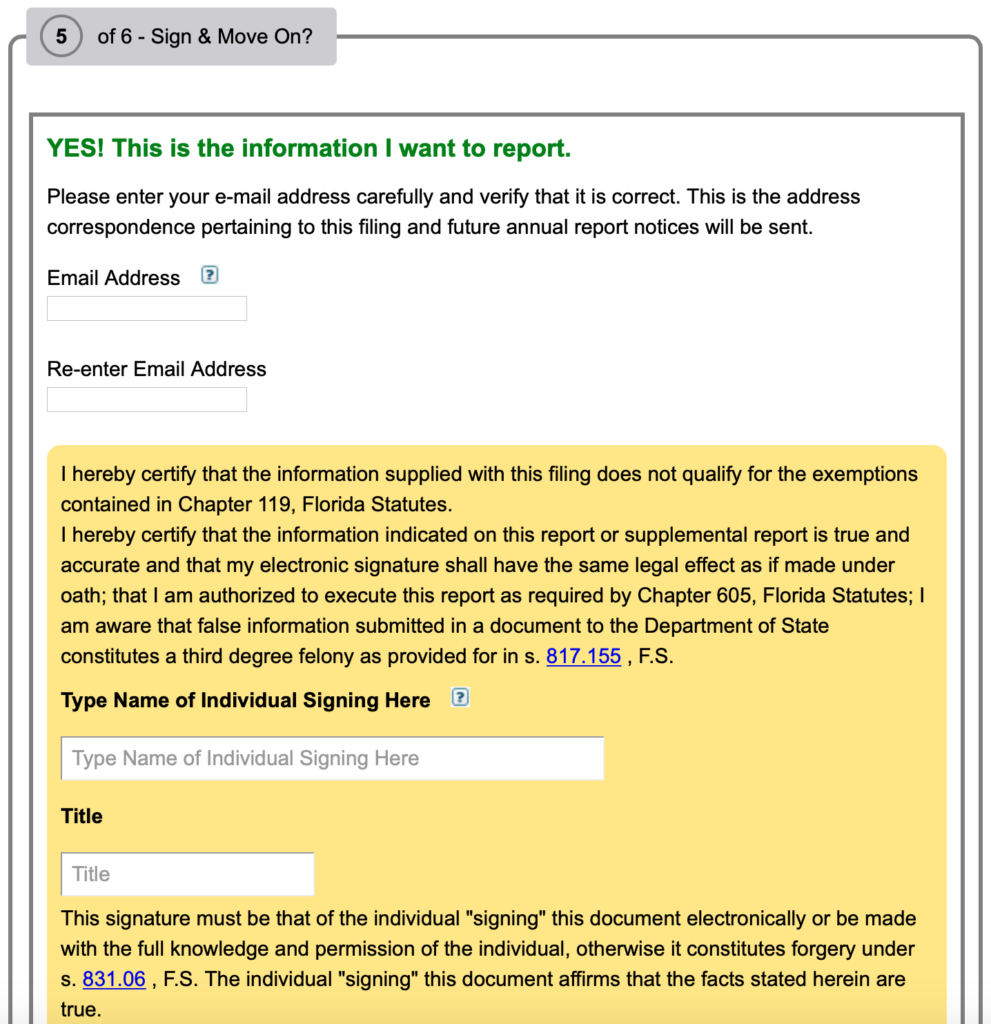

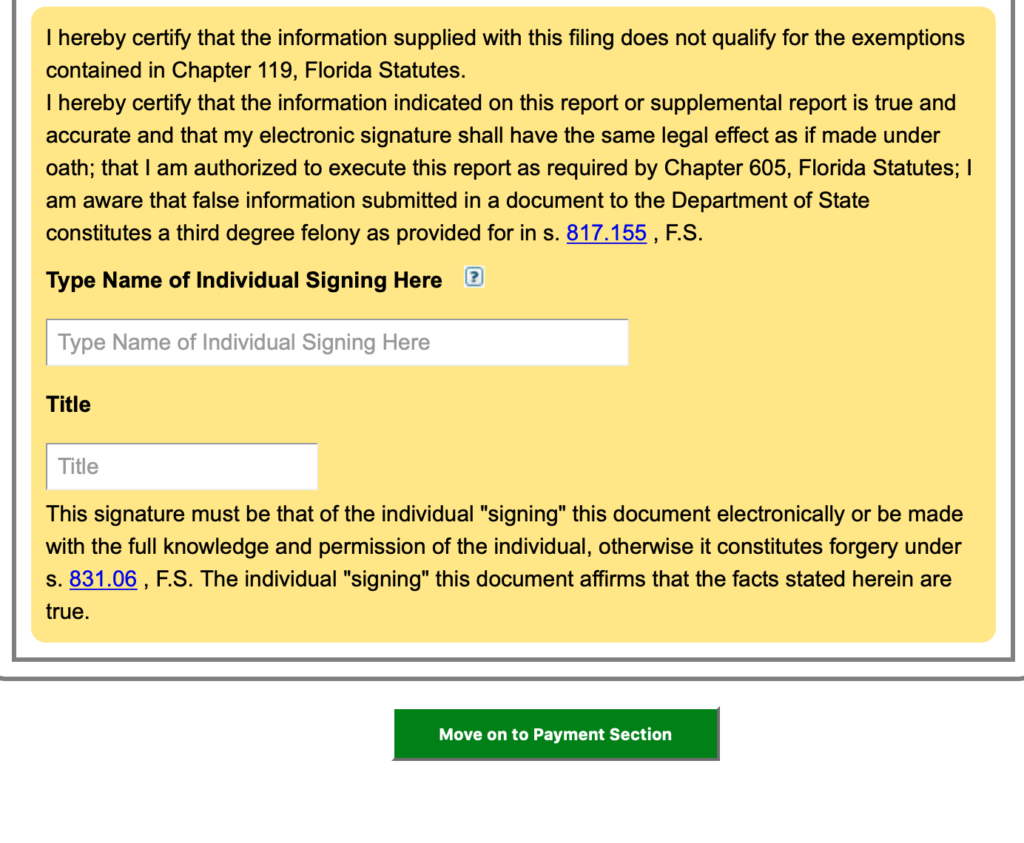

# Electronic signature

And then move to the most important part: payment.

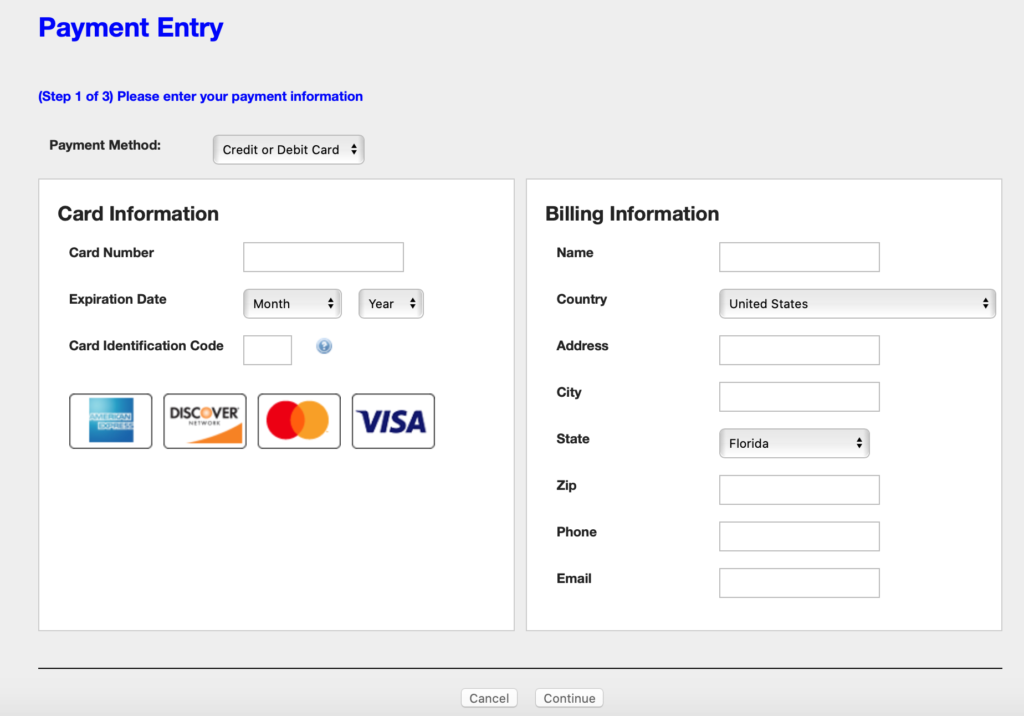

# Payment

Pretty standard options.

The payment part looks looks very standard, much like online shopping.

All done.

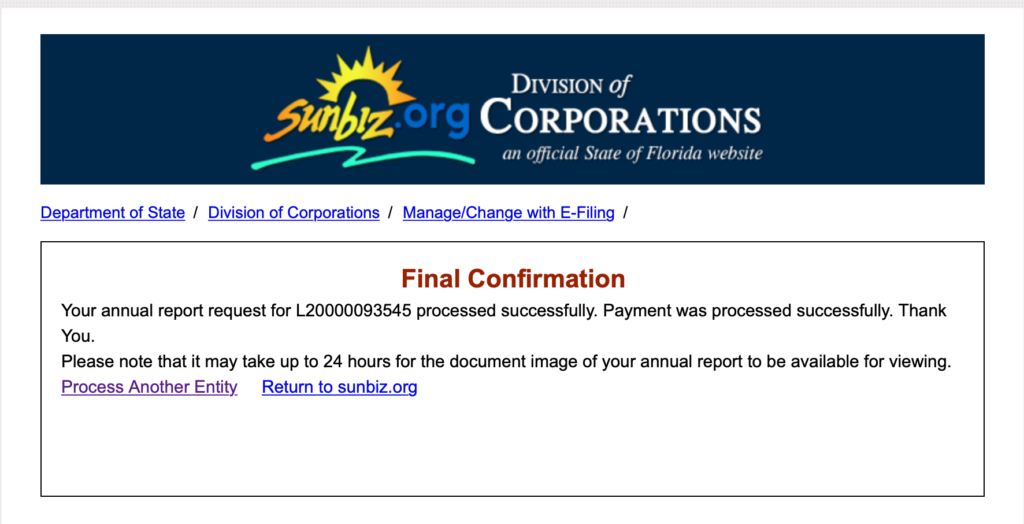

# Confirmation

Please keep for your records- though you also get an email confirmation.

And that’s all there is to it. Once a year and done. Hope it helps, thank you!