We continue here with the second part of Contributors to Credit Score- check out Part 1 here. We dealt with the two biggest contributors, namely, payment history and amounts owed in the first part of the presentation. Here we’ll talk about the rest. The video is right here, too.

Length of Credit History

It contributes 15% towards your Credit Score.

The longer history of responsible credit behavior you have, the better for your score.

The age of your oldest credit line and the average age of all your credit lines together are taken into consideration.

In the FICO study, high achievers had an average age of credit accounts of 11 years and their first credit lines dated back an avg of 25 years.

Closing a Credit Card

What effect, if any, do you expect to see on your Credit Score from closing a credit card?

First, some things to note:

- You still have to pay off any balances even if you close a credit card. Otherwise, you pay interest & other charges. And if you do not make even minimum payments, the negative information get reported to the Credit Bureaus as usual.

- Any pre-existing negative information regarding that card still stays on your Credit Report until the 7 years are up.

- Immediately upon closing the account, its associated Credit Limit is removed from utilization calculations. This may cause a jump in your Credit Utilization Ratio and drop your score.

Say for example, you have 3 credit cards on which you put a total of $6,000/month. The total credit limit on these cards is $40,000. So, your Utilization Ratio is a decent 15%. You decide to close one of the cards which has a Credit Limit $10,000. What happens next? Your total Credit Limit falls to $20,000 and your CUR jumps up to 30%. And your Credit Score likely sees a drop.

If, however, your overall CUR is low and you can keep it low despite closing the account, you should be fine.

- A closed credit line stays on your Credit Report as a trade line for 10 years from the date of closure. So there is no immediate effect on the length of credit history. Once 10 yrs are up, that account falls off your Credit Report. At that time, it may hurt your average length of credit if you had had the account for a long time. This is especially important if it was your first opened credit line or if your other lines of credit are much newer.

So, from the point of view of your Credit Score, closing a credit account is usually either neutral or negative , hardly ever positive. There may of course, be other benefits to closing a card- both tangible & behavioral.

Credit Mix

Credit Mix accounts for another 10% towards Credit Score.

There are 2 basic kinds of credit: revolving and installment credit.

Revolving Credit

The classic example being Credit Cards.

- the lending institution specifies a maximum loan amount. This is called the Credit Limit

- account balances vary, depending on needs

- there is interest and carry forward charges if not paid in full every revolving period, usually monthly

- they are set for lower limits but charge higher interest since they are unsecured loans, ie, not tied to any collateral.

Installment Credit

Examples are mortgages, student loans, auto loans and other similar loans

- they have a fixed loan amount called the Principal

- this and the interest on it is paid out in equal monthly amounts over a pre-specified period of time: the loan duration

- they have higher limits than revolving credit. They are usually secured by a collateral- such as the real estate being financed by the loan. Hence, the interest rates are lower than on revolving credit.

Having a little bit of both kinds of credit represents a healthy mix for scoring purposes. Though you don’t have to get or keep a loan simply for this reason.

FICO high achievers have an average of 7 open and closed revolving trade lines and 4 with balances.

New Credit

This makes up the last 10%.

- How many new accounts opened in the prior 12 months, and

- how long it has been since you opened your last new account.

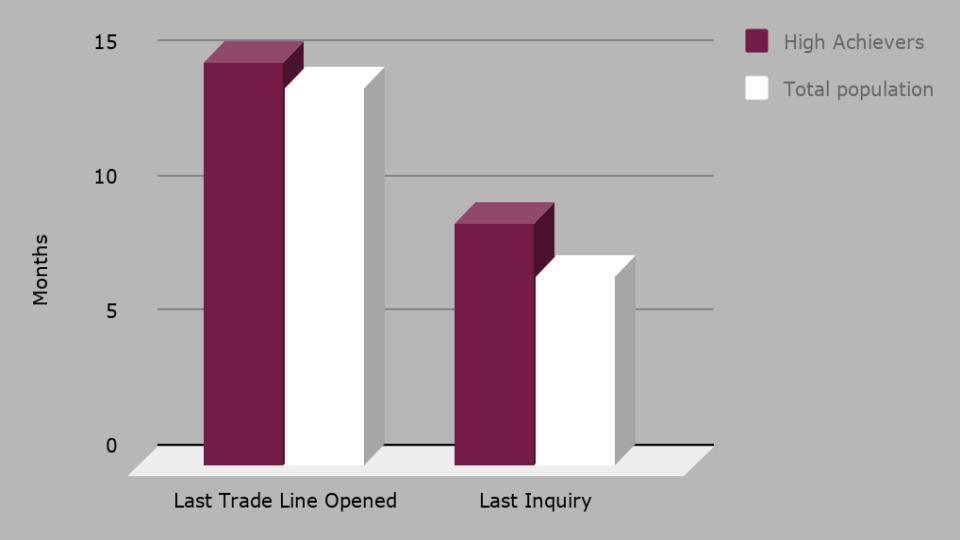

For FICO high achievers, it was 15 months since their last trade line was opened and 9 months since the last inquiry.

New credit is tracked by the number of inquiries into your Credit Report. When you apply for a new loan, the lender asks the Credit Bureau for your Credit Report. It then gets flagged as a “hard inquiry”.

A single inquiry may not make a huge difference to your score, but a number of them in close succession will.

Rate Shopping

The exception to this is allowed during “rate shopping”. For e.g., when you are seeking a new mortgage, you will want to shop around for the best terms. As long as all the inquiries with regard to this mortgage fall within a 45-day window, it is considered to be a single inquiry.

Point to note, VantageScore allows only a 15 day window for rate shopping. The good thing is most mortgage lenders still rely on FICO scores. It may be more important for auto or other loans.

As opposed to “hard inquiries”, “soft inquiries” do not negatively impact your score. Some examples are:

- *You checking your own score at AnnualCreditReport.com or directly from the Credit Bureaus

- Institutions that you already do business with checking your report &

- Unsolicited credit card offers or mortgage pre-approvals in the mail

Increasing Credit Limit

Asking for an increase in credit limit may sometimes result in a hard inquiry. So be sure to find out. Often, the credit card company will increase your limit upto a certain level without pulling your credit; anything over that you ask for will trigger a hard inquiry. Therefore,

- don’t ask for an increase more than one card at a time- the multiple credit pulls may ding your score significantly

- don’t ask for an increase right before you are planning to take out a big new loan-when you dont want to risk even a small dip in your score.

I do want to point out that our discussion regarding these factors holds true in general, but the proportional importance of each factor will vary, depending on your credit file. For instance, if you have a short credit history, your payment history and Credit Utilization Ratio become all the more important.

Thank you for reading! Please let me know your thoughts in the comments below.