We are continuing our series on All About Credit. Check out the earlier posts on Credit Report: The Basics and the Credit Scores: the Basics, if you haven’t already. Today we’ll talk about the contributors to your Credit Score. I have divided this presentation into 2 parts to keep them short. Watch the video or scroll on down to read.

What Goes into your Credit Score?

The all-important question: what goes into your Credit Score? And therefore, what can you do to improve it?

As you’ve seen before, there is not one but multiple Credit Scores, each with their own tweaks to the algorithm. But the basic principles remain the same.

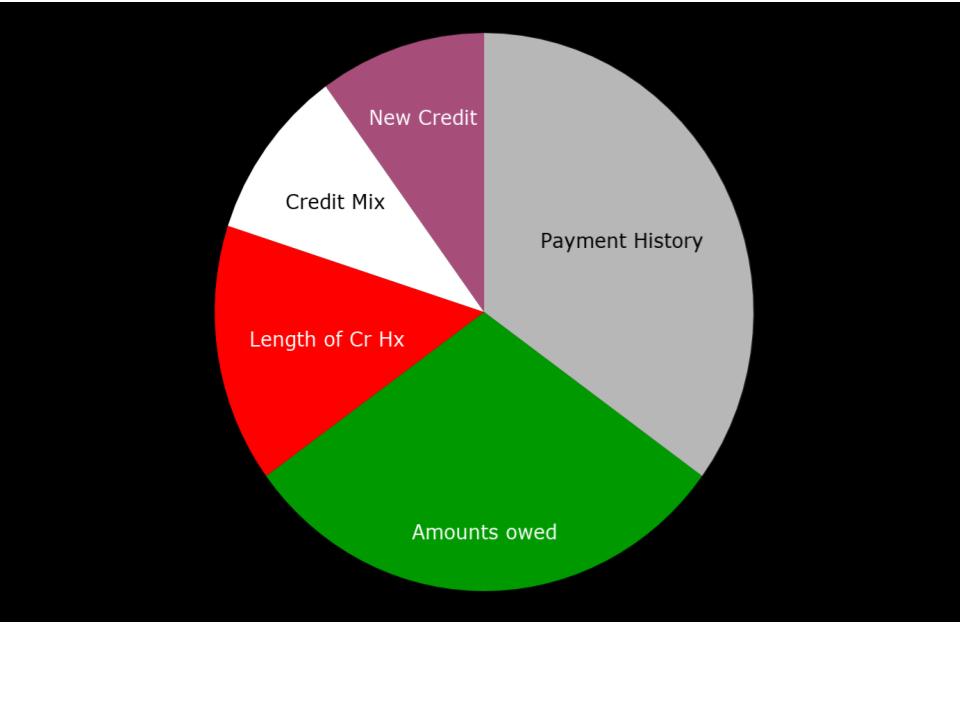

The 5 big players in your Credit Score, in order of importance are:

- Payment History

- Amounts owed

- Length of Credit History

- Credit Mix, and,

- New Credit

Payment History

The biggest contributor, at 35%.

By payment history, we mean whether you are on time with your credit payments or if you are late with them. It considers all different types of credit lines: bank and store cards, mortgages and other loans. A late payment stays on your CR as negative information for 7 years.

The degree of impact on your Credit Score:

Depends on a number of factors:

- How late the payment is. First, credit card companies are allowed to report a late payment to the Credit Bureaus only if it is at least 30 days past due date. From there on, the later the payment is posted, the worse the impact on your score. Until at 6 months, they will write off the loss and report the account as charged off. Which makes your score drop precipitously.

- The bigger the amount in question, the worse the impact.

- One late payment is better than repeated offenses.

- Time: the impact is largest when it first happens and slowly recovers with time. Finally, at 7 years, it falls off your Credit Report.

How much is the impact on Credit Score?

Since there are so many moving parts, exact numbers are hard to come by. If you have good/excellent credit to begin with, a single late payment may drop your score by 50-60 pts. I found this out the hard way by once forgetting to pay a $100 retail card bill. Interestingly, if your Credit Score is not so great to start with, the impact is lower.

FICO High Achievers

FICO, the credit scoring giant performed a study in 2014 of the top quartile of scorers: Those with Credit Scores greater than 800, the “FICO High Achievers” and studied their profiles.

- 96% of them had never made a late payment, as opposed to 57% of the total population

- Of the other 4%, the last late payment was almost 4 yrs back.

Amounts Owed

This is the next biggest contributor: at 30%.

It considers balances on both revolving accounts, such as credit cards as well as installment loans- such as mortgages and auto loans. But revolving accounts carry more weightage in this category than installment loans.

Installment Loans:

For installment loans, it is pretty straightforward. It is the amount of the loan still owed.

Revolving Accounts:

For credit cards, amounts owed is the balance you carry from month to month. Even if you pay off your cards in full each month, the amount owed is not zero. It is your last account balance. Sometimes, this is different from your statement balance since the lender may report your balance to the Credit Bureaus at a certain pre-specified time, say, the last business day of the month.

Credit Utilization Ratio (CUR)

The underlying concept behind amounts owed is Credit Utilization Ratio: What proportion of the credit limit extended to you are you using?

If you are using close to your maximum credit limits, it is a sign that you may be stretched too thin and may have trouble paying off current or new loans.

CUR is an easy mathematical calculation:

Account Balance/ Credit Limit x 100, expressed as a %

Credit Utilization Ratio Facts

- Your Credit Report calculates the CUR for each of your accounts individually as well as overall, all accounts combined.

- The lower your CUR the better. It is worth noting though that a low Credit Utilization is better than no utilization. Without any credit usage, your Credit Report has little to go on and your score starts trending down.

- The FICO Study noted that high Achievers had a median utilization of 4% & highest utilization of 10% on their revolving accounts. Both numbers were much higher for the total population.

- A sharp spike in Utilization Ratio may negatively impact your Credit Score to the tune of 10-50 points. If you max out all your credit lines, your score could plummet by 100 pts or more.

Lowering your Credit Utilization Ratio

How do you lower your CUR? Like any ratio, either by reducing the numerator or increasing the denominator.

Reduce Account Balances:

- the no-brainer option is to reduce spending. But if spending is not the problem, and if your credit card allows it,

- you can split your payment into 2 parts every billing cycle, thereby lowering the balance at any point in time. If that’s not allowed,

- you can reset your billing cycle to start right before your balances are reported to the Credit Bureaus. For eg., if they report to the bureaus at the end of the month, starting your billing cycle on the 15th or 20th of every month will help reduce the reported balances. Check your Credit Report or ask your lender for reporting date.

- Yet another option is to pay off a big ticket item as soon as you put it on your card, instead of waiting till the end of the billing cycle.

To increase the denominator, increase your credit limit. Remember though that the math will work only if you don’t simultaneously increase the numerator, ie, spending.

Increase in Credit Limit

Apart from dropping your Utilization Ratio, a higher Credit Limit may let you put a big purchase on your card- which may have reward benefits.

To increase your total Credit Limit, you have 2 options. Either increase the limit on an existing card or get a new card.

To increase the limit on an existing card, you could either ask for one or wait for an automatic increase. Credit cards will do periodically do this for consumers with good payment history and adequate income. Note: The income you report is not independently verified by the cc co- its accuracy is your legal responsibility.

Credit utilization and amounts owed calculations take into account only the last reported balances and credit limits and your highest-ever balances. So, you want to pay close attention to your credit utilization right before applying for a big loan, such as a mortgage.

Even though amounts owed/credit utilization accounts for almost as much of your credit score as payment history, a high Utilization Ratio is far more forgiving to your score than a late payment since the points losts to high utilization are regained as soon as the high balance comes down and is updated at the bureaus, usutally in a month. On the other hand, points lost to late payment take years to recoup.

We will end this here post and continue in the second part of the presentation- do check it out.