Welcome to the second post on All About Credit. If you missed the first one on Credit Report: The Basics, watch or read it here. Today we are talking about Credit Scores: The Basics. The video is right here. If you prefer to read, scroll on down.

What is a Credit Score?

It is a numerical assessment of your credit worthiness. Put simply, a number that denotes what kind of risk you present as a borrower to a lender. It is based on information in your Credit Reports- reached at by a mathematical algorithm by the agency providing the score.

Just like your Credit Report, it is constantly changing based on your credit behavior.

The number is usually between 300-850 or 900. And higher is better, though there is no absolute cut off for good or bad. It depends on your credit file and your specific situation.

With a better Credit Score, you are deemed lower risk for lenders and can therefore land better terms on your loans. Around 750 is a common threshold for “good” terms.

The credit scoring system is not perfect- it attempts to gauge the future by past performance.

Scores of Scores

You have not one, but multiple Credit Scores. The most commonly known one is called the FICO (or Fair Isaac Co) score- named after the company that first came up with this idea of a credit scoring algorithm.

FICO Score

Remember, you have three Credit Reports from the three credit bureaus. They pay FICO to generate your scores based on this data. So, you have 3 FICO scores, one each for the 3 Credit Bureaus.

Since the information in your Credit Report at the 3 Bureaus is not identical, you can expect some variation in your 3 Credit Scores. Up to a 20-point difference is acceptable.

Lenders look at different Credit Scores for different purposes. For high risk loans, like mortgages, lenders like to look at scores from all 3 agencies. They generally pick your median score. If you are co-borrowing with a spouse, they will pick the lower of your two medians (Of course, right?).

VantageScore

For a long time, FICO didn’t have any competition. Then, in 2006, the 3 Credit Bureaus came together to create an alternate scoring system. That’s how VantageScore was born. Similar to FICO, you have 3 Vantage scores.

Though VantageScore is slowly gaining ground, until now at least, FICO continues to be the market leader.

Over the years, there have been different versions of FICO and VantageScores. The latest versions are FICO 9- though FICO 8 still continues to be the most popular- and VantageScore 4.0- which rolled out in late 2017.

Industry Specific Credit Scores

Apart from these “base” Credit Scores, there are also industry specific scores: for example, FICO Auto Score or FICO Mortgage Score or FICO Bankcard Score- which have greater predictive accuracy for specific situations.

The FICO Mortgage Score is notable in that it uses older versions of FICO, which are less forgiving to negative credit information. Mortgages are huge risks for lenders and they like to err on the side of caution.

How do FICO and VantageScore compare?

Both of them look at the same basic credit factors- payment history and the like. The recent versions of both range from 300-850.

But there are some key differences:

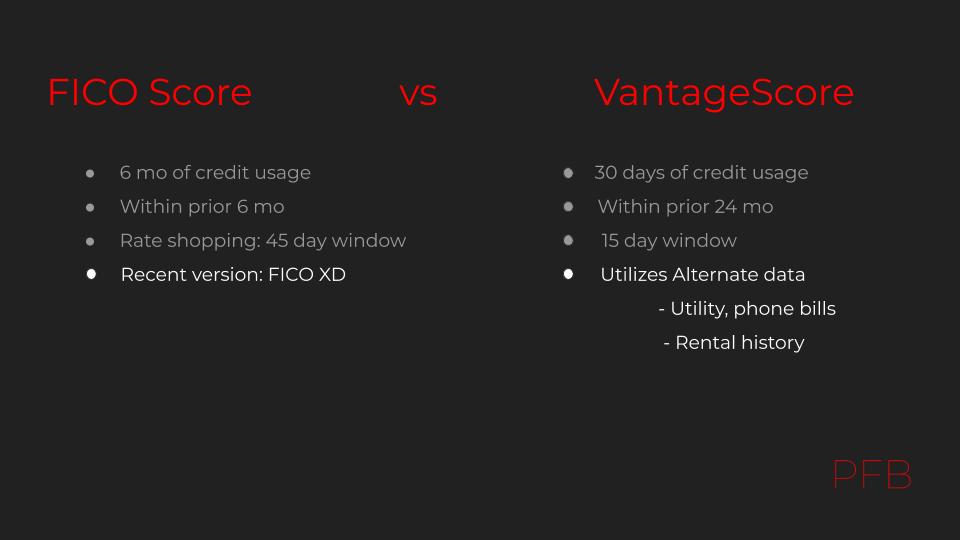

*To have a FICO score, you need to have at least a 6 month of history of credit usage; at least part of it within the prior 6 months.

*With VantageScore, only a 30 day history of credit usage suffices. VantageScore will also go back 24 months to look for this history. So, those with spotty credit or those towards the beginning of their credit journeys- for example, young adults or new immigrants to this country- are more likely to have a VantageScore rather than a FICO score.

*When you are rate-shopping for a new loan, FICO gives you a 45-day window to shop around without dinging your score. VantageScore gives you only 15. The importance of this lies in “new credit inquiries”, which we will talk about later.

*For those with a poor or short credit history, VantageScore also looks at alternate data- such as utility & phone bills or rental history. FICO also recently released a version called XD that utilizes this kind of data to score previously unscorable people.

FICO has been criticized in the past for being too exclusionary and therefore their newer versions lean less towards negative credit information. For example, they ignore collections that have been paid in full and are more forgiving towards medical bills sent to collection agencies.

Some of these changes make the newer versions of FICO and VantageScores more similar to each other than they started out.

Where Can you Find your Credit Scores?

Getting your Credit Score has never been difficult online. A simple google search will yield a number of sources. However, many of them are not your “real” scores.

They may not be a FICO or VantageScore at all, but a different algorithm specific to that company. A true FICO or VantageScore will always have the trademark name.

Even if they are your FICO or VantageScore, until lately, you used to get the consumer version of your Credit Score or “Educational Score”. This version is different from the actual version used by lenders when you apply for a loan. They are likely within the ballpark of your real Score. But in a situation where a difference of 30-40 points makes a huge dent in the terms of loan you can secure, it is less helpful.

The credit scoring companies have worked with banks and lending institutions to give consumers more access to their true Scores. And now many banks and credit cards offer free updated Credit Scores as a perk for account holders.

VantageScore is widely available for free via many personal finance services websites if you sign up for their subscriptions. Some examples are Credit Karma, Credit Sesame, MyBankrate.com, Nerdwallet, etc.

If you are willing to spend the money, you can always purchase your Credit Score directly from FICO. Combine this with your annual free credit report directly from AnnualCreditReport.com and you can keep a pretty close eye on your credit.

This was the Basics of Credit Scores. Read the following posts on the Contributors to your Credit Score to know more. Please let me know if you have any questions or comments. Thank you!