You’re sitting down to write your Investment Policy Statement. You have a couple of hours set aside for it, and your favorite mug is steaming or fizzing full of your favorite beverage. You know your goals- how much you need and when to get there. You know you have to invest. But how, that is the question. So, let’s talk about the basics of asset allocation.

Asset allocation refers to how we divide up our assets into different asset classes in certain proportions.

Asset Classes

The basic asset classes are:

- Equities or stocks- which is part ownership of publicly traded companies.

- Bonds- which are loans given to different entities, such as companies or governments,

- Cash and cash equivalents. Cash is easy to understand- it includes cash under your mattress or money in your bank accounts. Cash equivalents are those investments that behave like cash- that is, their value does not fluctuate significantly. They include short-term CDs and very short-term debt securities that mature within 3 months or less.

- Alternative asset classes- this includes real estate and anything else that is not covered above. This can range from cryptocurrency to collectibles and everything in between.

Purposes of Each Asset Class

There is a purpose to each asset class. Understanding that helps you decide which asset classes should be part of your portfolio.

- Equities are higher risk and therefore must be higher return (otherwise no investor would take the uncompensated risk). The returns of this asset class, over the long term, reliably exceed inflation. Therefore, unless you intend for most of your retirement nest egg to come from brute savings, you do need to invest in equities to get there.

This upward climb in value however, does not follow a straight line. It goes up and down due to volatility.

Theoretically, you can ignore the volatility, because if you do not sell your shares of stock, the up and down movement is all on paper- you’re not taking any real losses.

Practically, it is another matter altogether. It can be gut-wrenching to see your hard-earned money disappear during a market downturn.

So, what do you do? You try to smoothen out some of that volatility with bonds.

- Bonds are generally lower risk and therefore earn lower returns than equities. So why would you want any? Well, they are less volatile and therefore serve to smoothen out the ups and downs of a portfolio.

So during 2008, your retirement account may have dropped 35% instead of 50%, if you had some bonds to temper the fall. Or from $700k to $455k, instead of $350k. Big difference. Not just the $105k per se, but it may have been just enough to not make you panic-sell during the downturn. (And if that was not enough to make you feel better, you needed more bonds).

There are different schools of thought regarding this, though. Not everyone agrees with this premise. They say that when you’re young and have decades investing ahead of you, there is no point in reducing your returns by adding bonds into the mix.

JL Collins is famously one of them. In Simple Path to Wealth, he recommends a 100% equity portfolio, invested in VTSAX: Vanguard’s Total U.S. Stock Market Index Fund.

- Alternative investments: Outside of real estate, I have no experience with alternative assets. I do not feel they need to be part of my portfolio or yours (I’m not including real estate when I say this). Unless you have a distinct advantage over others, due to knowledge or skill set, it is harder to “make it” with these. And if you’re doing it without enough knowledge, it borders on speculation, not investment.

Real estate is a great vehicle to build wealth. But I still feel my chances of reaching my goals are better with equities. The stock market is very efficient- if you’re investing in broad-based index funds. That makes it fairer for the regular investor. Real estate is a lot more inefficient. To take advantage of that means that you have to have something another person may not have (knowledge/skills/time).

Asset Allocation: The Why

Now that you know what each asset class brings to the table, you can pick how much of each you want.

It is usual to pick equities as the backbone of your portfolio- which will drive returns through the years. Add some amount of bonds to keep the volatility down. And some real estate, if you want to.

There are endless permutations you can go with, which also leads to the possibility of analysis paralysis. Don’t let that happen:

#1, because minor differences in asset allocation is not going to make or break your retirement. But more importantly,

#2, because we cannot predict the future. Dr Bill Bernstein said it really eloquently in his book, The Four Pillars of Investing: “During the next 20 or 30 years, there will be a single, best allocation, that in retrospect we will have wished we have owned. The only problem is that we haven’t a clue what that portfolio will be. So, the safest course is to own as many asset classes as you can; that way you can be sure of avoiding the catastrophe of holding a portfolio concentrated in the worst ones.”

Risk Tolerance

The particular asset allocation you pick depends on your need, ability and willingness to take risk.

Remember we said above that an asset that has a higher return must also have higher risk. Essentially, there are no free lunches. So you get to decide how much risk you need to take, are able to take or are willing to take.

Say you are starting to save and invest really late in the game. Maybe you’re 55 years old and have no retirement savings. You want to retire in 10 years. And you’ve decided you need a $2 Million portfolio to retire on $75k a year. Can you save $200k a year to get to $2 Million in 10 years? If not, well, you need to take on some risk in order to get there.

How about your ability to take risk? I don’t think you can go for a 100% stock portfolio, even though that *might* give you the highest returns, because your investment horizon is shorter and you may not have the time for the portfolio to recover from a downturn.

Also, the sight of your portfolio halving only a few short years from retirement may be too much and cause you to panic sell during a downturn. And that would be devastating. So you’re not willing to take on that risk.

Together, they make up your risk tolerance. And is vital to consider when setting your asset allocation. It trumps everything else when choosing an asset allocation.

JL Collins, when he recommends the 100% stock allocation, does not mince words about risk tolerance. If you want to get to your goals, “toughen up, cupcake”. This is great if it works and a disaster if it doesn’t. Especially, if you find out you’re not “tough enough” at the bottom of a bear market.

Asset Allocation: The How

Now that you know your risk tolerance, you’re ready to set your asset allocation.

We talked above how JL Collins recommends a 100% stock portfolio. Most other experts disagree.

John Bogle, Vanguard’s founder, is on the other side of the fence. He recommends “roughly your age in bonds”.

Benjamin Graham, Warren Buffett’s mentor, suggests no more than 75% and no less than 25% in stocks in his book, The Intelligent Investor.

The Bengen Study and the Trinity Study– upon which the 4% Rule is based, found the sweet spot between returns and portfolio longevity at 50-75% stock allocation, depending on how much risk you’re willing (or able) to take. Please note, this applies only to low cost, broad-based Index Funds and intermediate-term high-quality bonds.

Lazy Portfolios

The simplest portfolio is an equal split between U.S. Total Stock Market Index Fund and U.S. Total bond Market Index Fund.

This is a basic “set it and forget it” lazy portfolio. It implies that the investor does not have to change asset allocation according to market conditions but only due to life events.

One can then go from here and adjust these proportions and/or add asset sub-classes to get the allocation you desire.

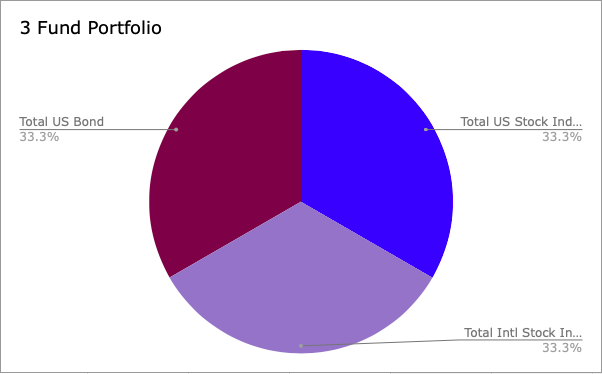

3 Fund Portfolio

As an example, a commonly recommended asset allocation is the Boglehead’s 3-fund portfolio. It recommends 3 broad mutual funds, in equal proportions, to address diversification:

- Total U.S. Stock Market Index Fund (33%)

- Total International Stock Market Index Fund (33%)

- Total U.S. Bond Market Fund (33%)

You can modify it to your risk tolerance by adjusting the proportions of each component.

Target Date Funds

Another way to accomplish this is by using a Target Date Retirement Fund. This is a “fund of funds”, widely available at most brokerages. They use some proportion of these and other broad-based mutual funds to achieve your desired asset allocation. What do you pay for the convenience? Additional fees, of course.

Slice and Dice Portfolio

If you want to increase the complexity of the portfolio, to eke out some more return, you can “slice and dice” the portfolio.

That is, you dice up each individual asset allocation into smaller slices.

The effect that achieves is, you are adding extra amounts of some components that you believe will beat market returns, or tilting your portfolio towards these factors. This is known as “factor investing“. Some common factors are value and small cap factors. So, you may add a fourth, small-cap value stock index fund to your portfolio. Then it looks something like this:

- Total U.S. Stock Market Index Fund (25%)

- Small-cap value Index Fund (8%)

- Total International Stock Market Index Fund (33%)

- Total U.S. Bond Market Fund (33%)

You can do the same for the Total International as well as the bond portions of your portfolio.

With this, we stop for today and will continue in Part 2. Thank you for reading! How does your asset allocation look?