Last week we saw that most of us will need a regular brokerage account, or taxable account, to house our savings, especially as we pay off student loans and have more to invest.

Today, we go through the steps of opening a taxable account. I am using Vanguard as an example since many of us use that platform. But the basic process is the same at other brokerage houses, too- kinda like the interfaces of different EMRs.

Open A Taxable Account

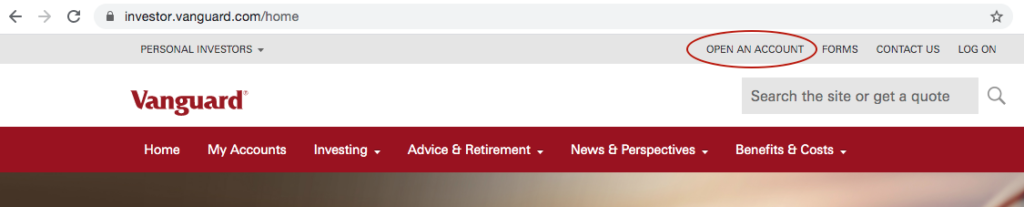

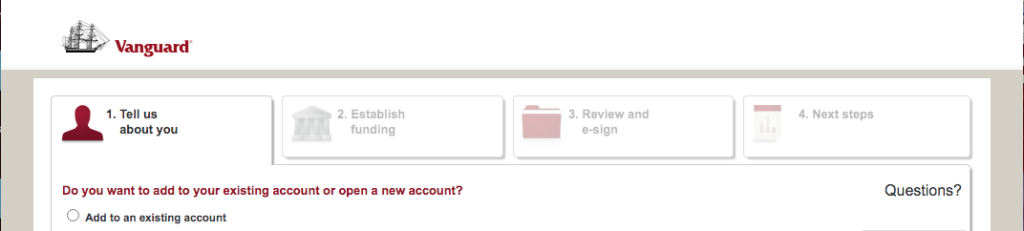

- Go to Vanguard.com

- If you have existing accounts (personal, not business accounts) with vanguard, you may log in first and then follow the steps to opening an account.

- Click on Open An Account in the upper right corner.

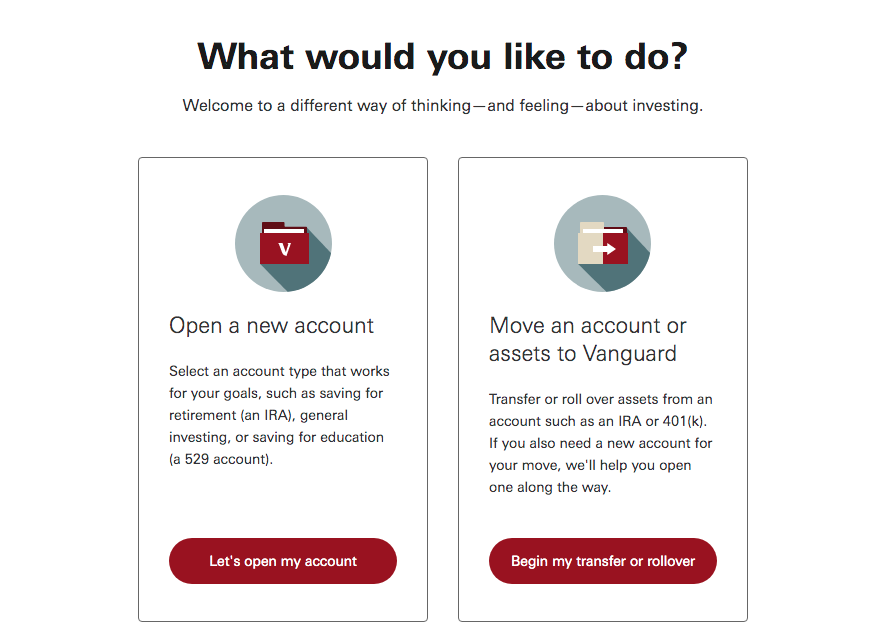

- It takes you to the next screen- asking if you’d like to open a new account or transfer an account from another custodian.

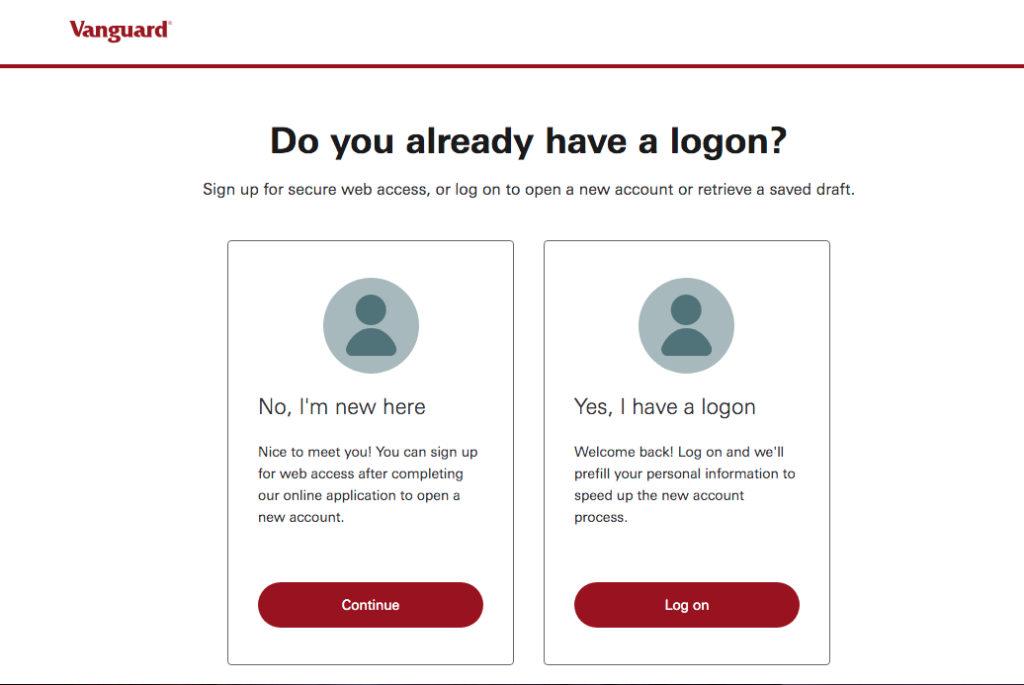

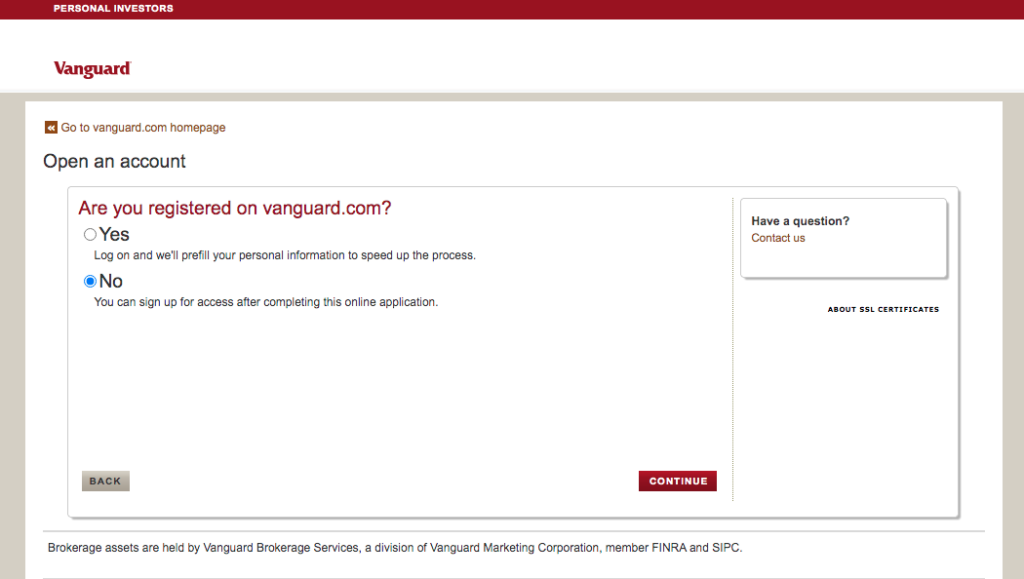

- If you are already registered with Vanguard, they want you to log-in next so the rest of the information can be pre-filled.

- If not, you will sign up for access with user ID, password and other forms of authentication (recommended) once you set up the new account.

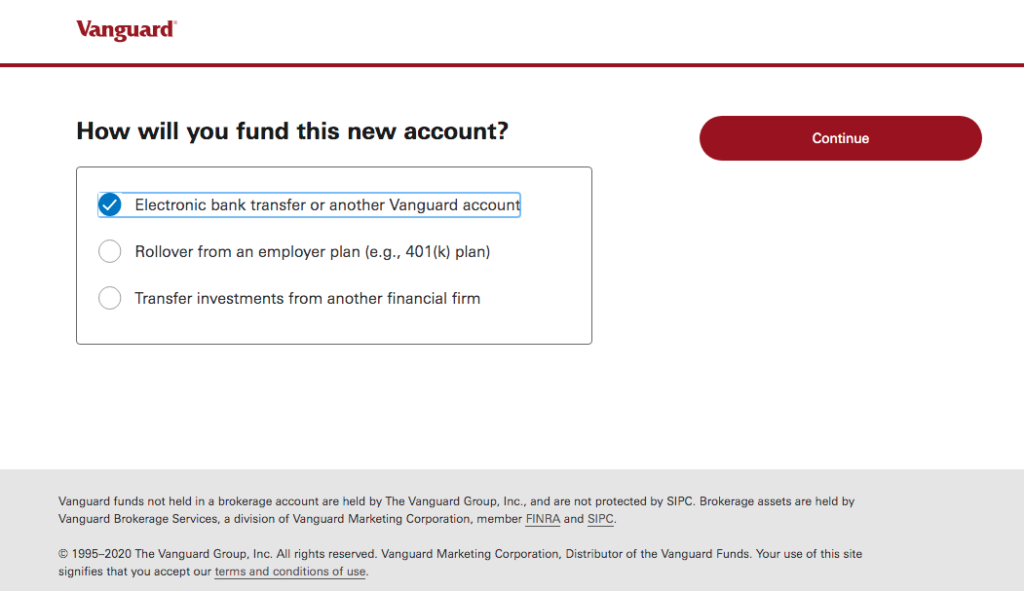

Funding The Account

- Since your purpose is to invest new funds in this account, you will want to electronically transfer funds from your bank account.

- If you are new to Vanguard or have no linked bank accounts, the process of verifying the account will take a few days.

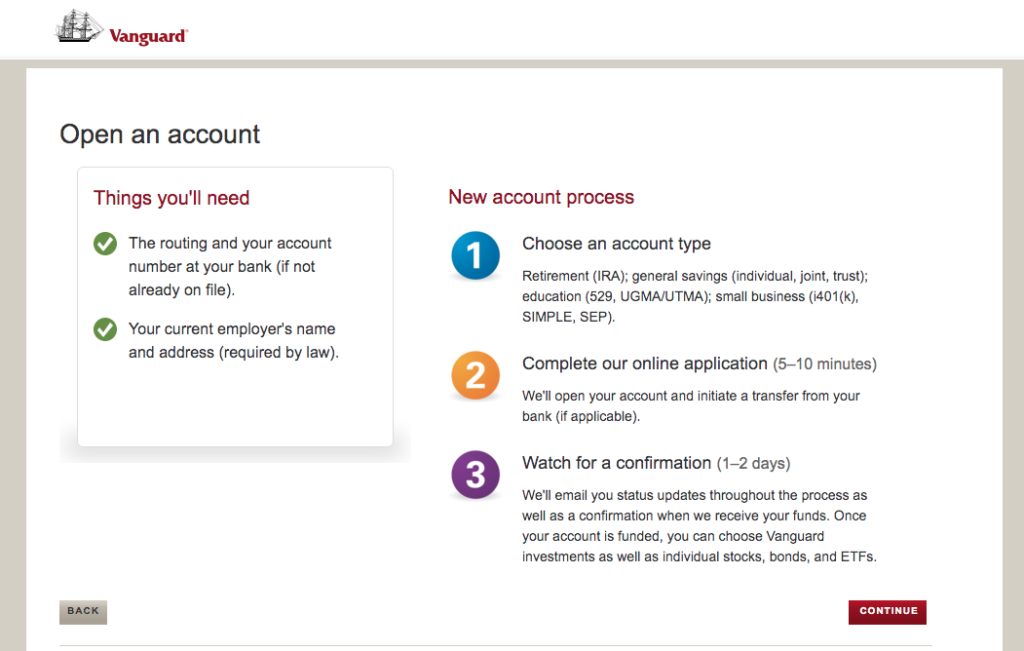

- The next screen gives you an overview of the process.

- Though the email confirmation takes a day or two, you can invest right away if you have an already linked bank account.

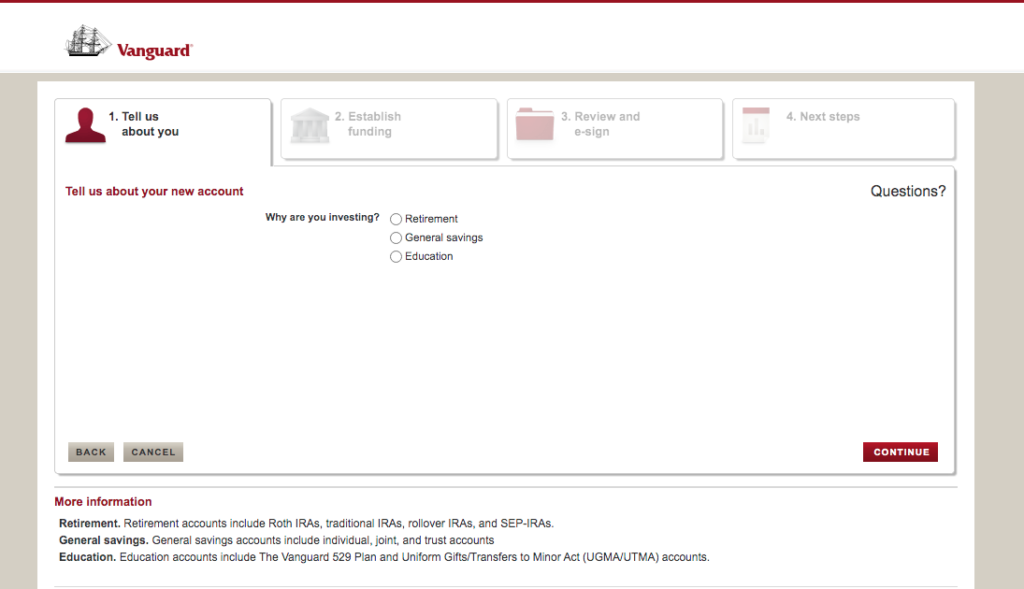

General Savings

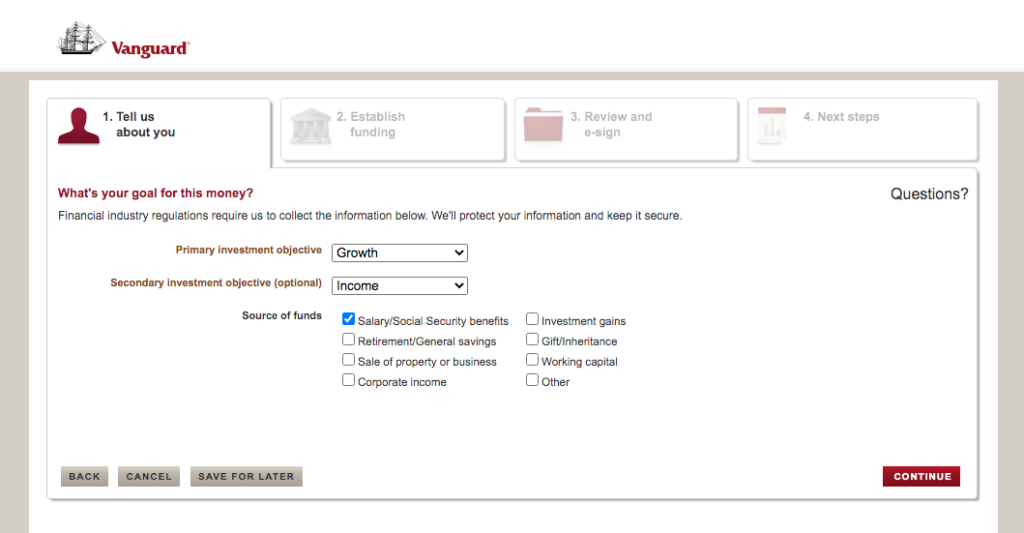

- The law requires a brokerage house to collect some basic information when an investor opens a new account.

- It asks you the purpose of the account. Now, most of us are investing in the taxable account for retirement but here you say “General savings”, since “Retirement” implies specific retirement accounts.

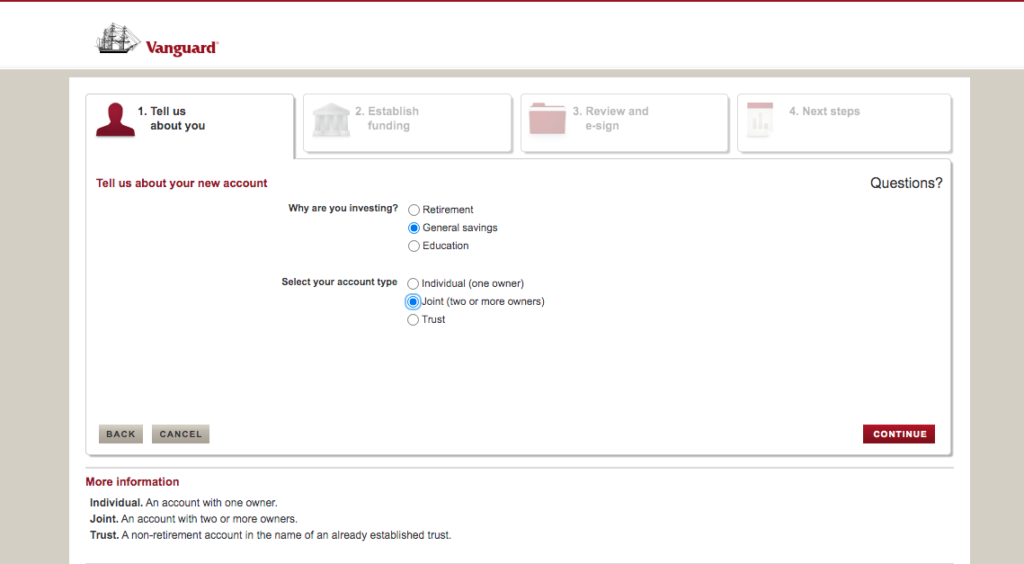

Individual or Joint Account

- Choose between Individual/Join/Trust account.

- I opened a joint account with my husband.

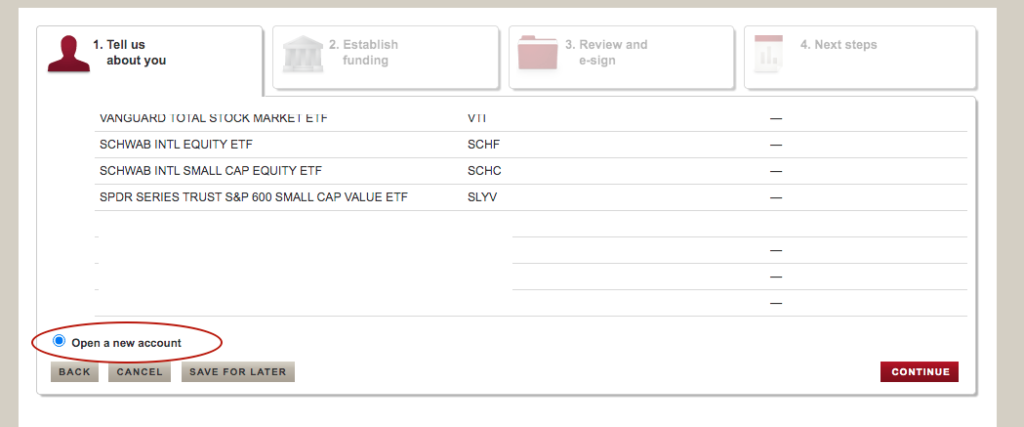

- Since I have a taxable account with Vanguard already, they just wanted to be sure I want to indeed open a new account, instead of just adding funds to my existing account.

- If you’re new to Vanguard, they will skip this step.

- I assured them that I did want to open a new account.

{P.S.: If anyone’s curious about all the Schwab funds on the screen, that’s the result of Tax Loss Harvesting when the market dipped in March}

- This is a good question: “What is your goal for this money?” How about letting me FIRE! Since that is not an option on the drop-down menu, I went for “Growth” and “Income”, since my asset allocation is aggressive.

- The source of the funds is current income, hence the choice of Salary.

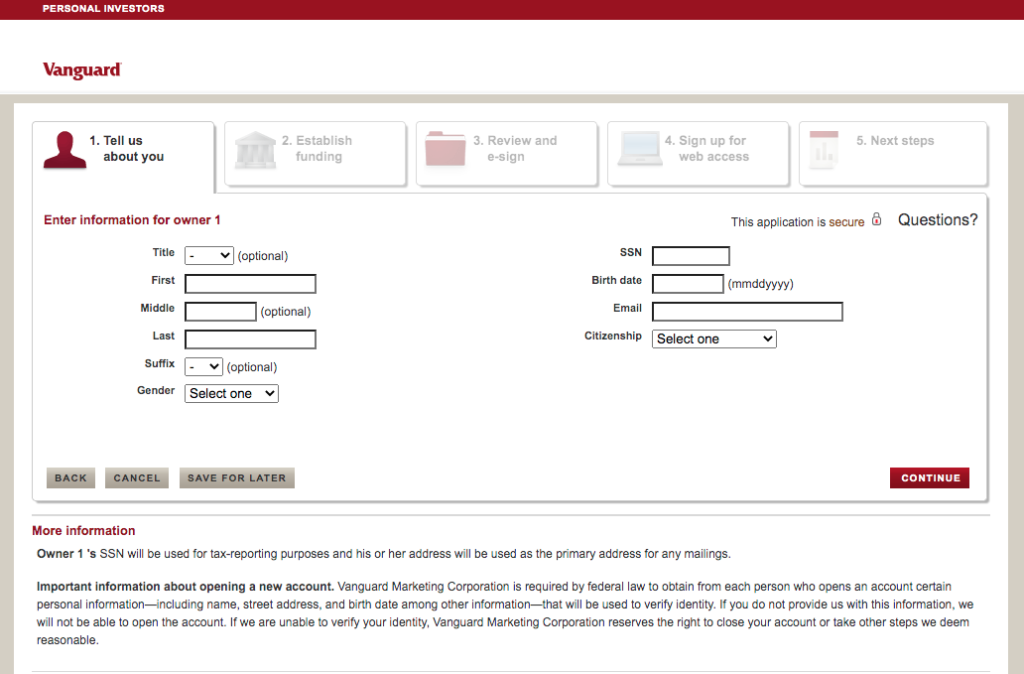

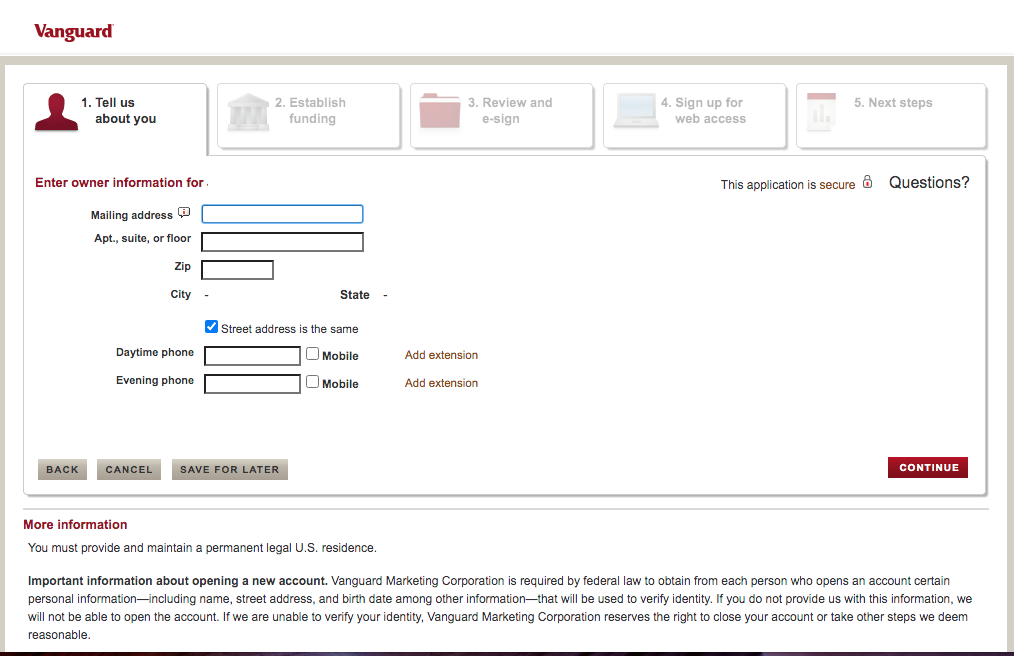

- Next, it asks you some details about yourself.

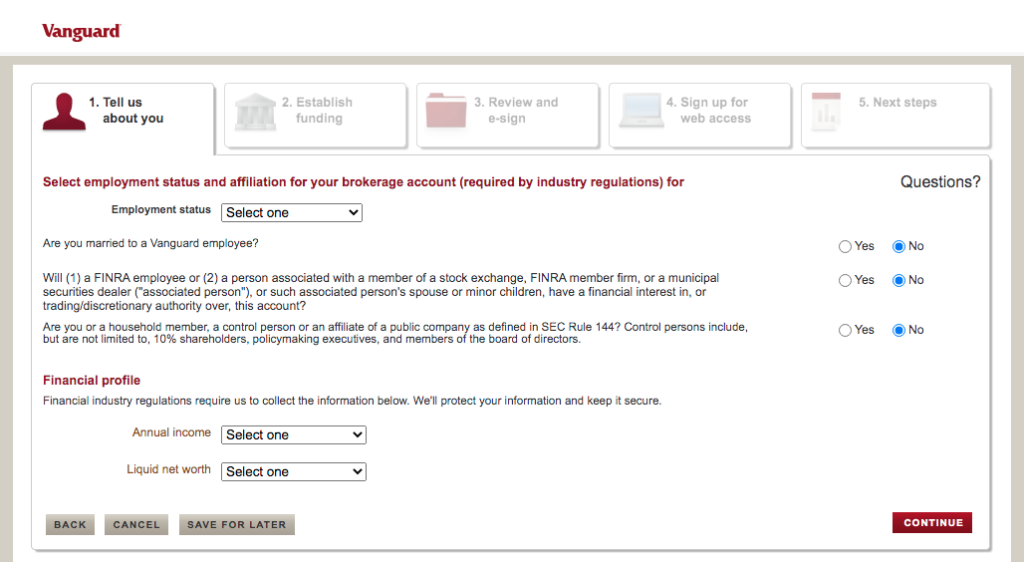

- They make sure to get the regulation questions out of the way.

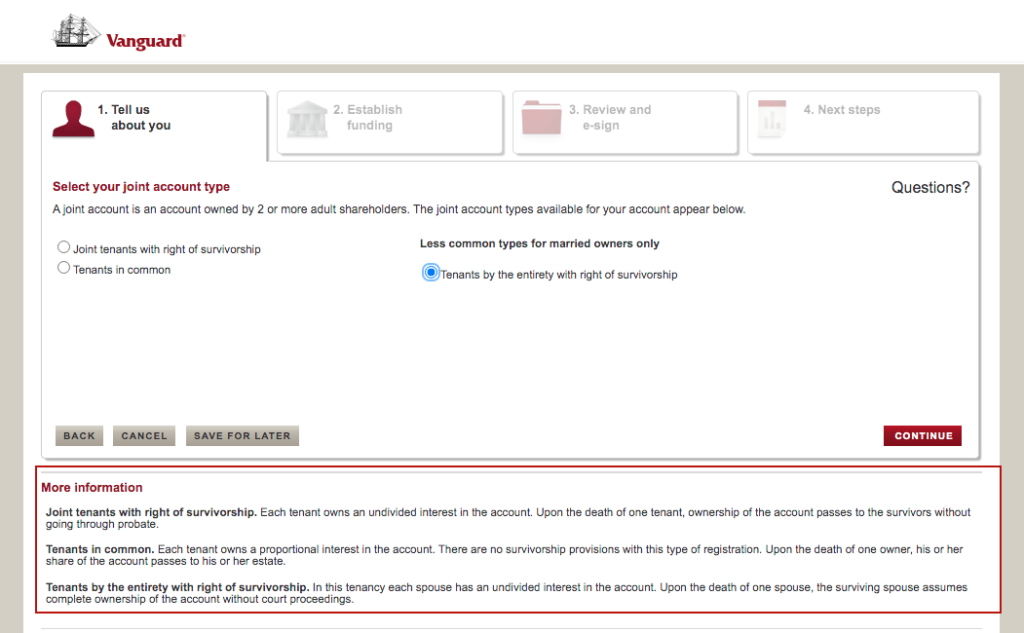

Structuring The Joint Account

- If your joint account is with your spouse, and your state allows Tenancy By the Entirety, this is the way to go.

- This simply means that each spouse owns 100% of the asset (not 50/50). Hence, the creditors of one spouse cannot lay claim to it, since it also belongs to the other spouse.

- This is useful for asset protection for physicians, and others, in case of malpractice suits, or even general liability above Umbrella Insurance limits.

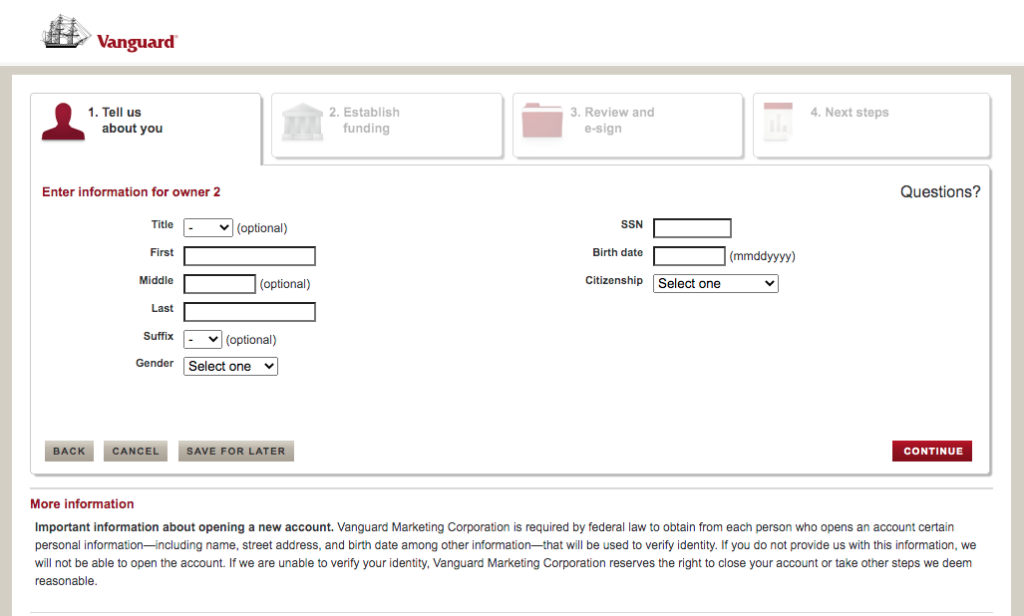

- You will need to have the joint account holder’s information handy.

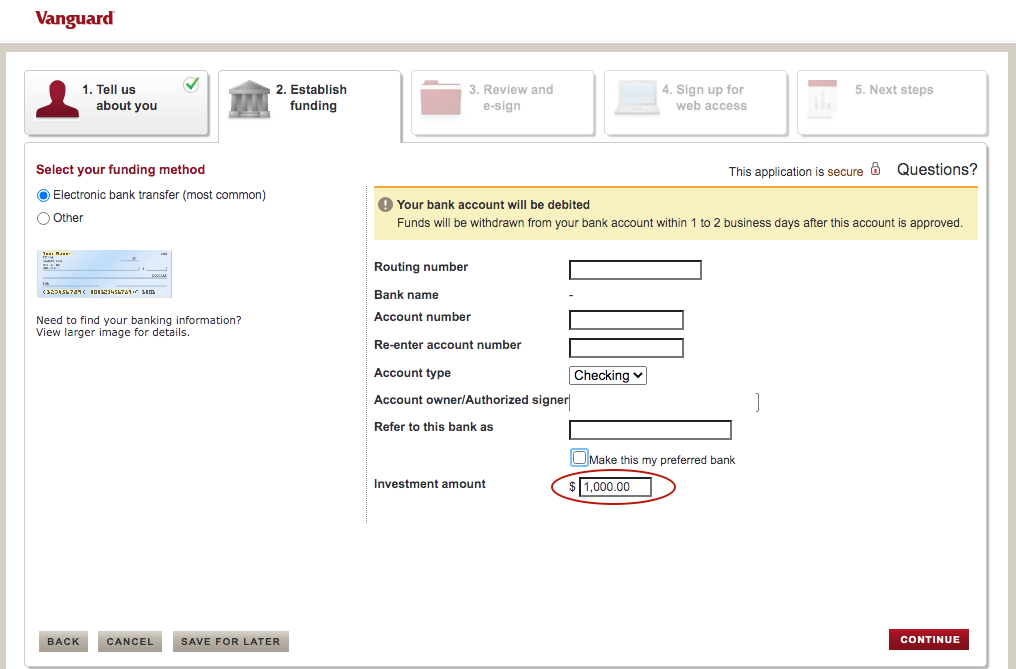

Funding Details

- They verify your bank account details, if you already have a linked account.

- If not, the linking process takes about 3-4 days and upto a week.

- It asks you how much you want debited from the bank to invest.

- For this example, I picked $1000 to start.

- There is no account minimum. However, the investments do have minimums.

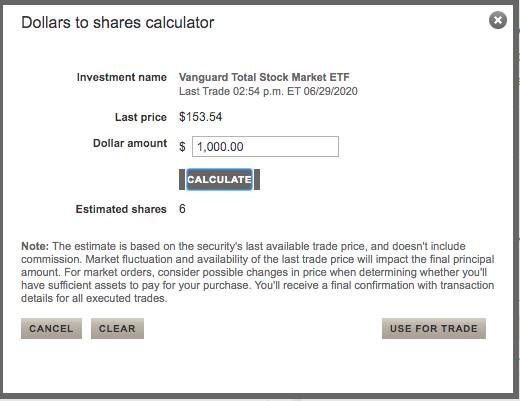

- For Exchange Traded Funds (ETFs), the minimum is the price of one share (for example, Vanguard Total Stock Market ETF is about $158 as of close yesterday). Vanguard does not allow you to buy fractional shares.

- For Mutual Funds, the minimum differs. For Index Funds- such as Vanguard Total Stock Market Index Fund (VTSAX)- which is just another share class of VTI above- the minimum is $3000.

- For some others, like actively managed funds, it may be $10,000 and above.

- Since I invest in ETFs, I’m good with the $1000 to start.

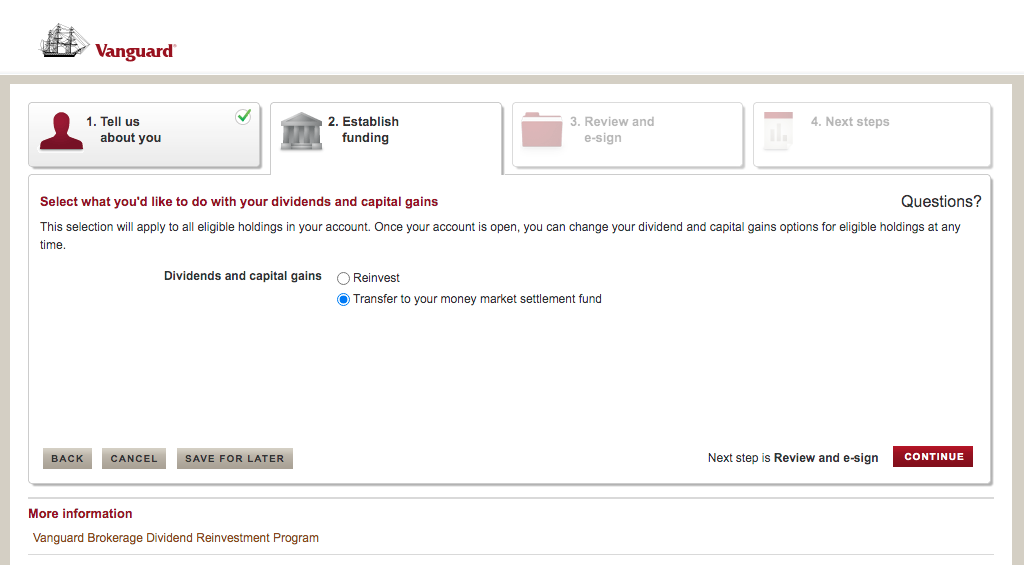

Dividends And Capital Gains

- As you get dividends and capital gains from your investments, there are two options to deal with them:

a) Reinvest them automatically into the same investments

b) Have them accumulate in the money market settlement fund. This is like a holding space within the account. This is where any money you transfer from the bank sits until you choose to invest it. This is also where the proceeds from the sale of an investment in the account goes.

Think of it as cash sitting within your account.

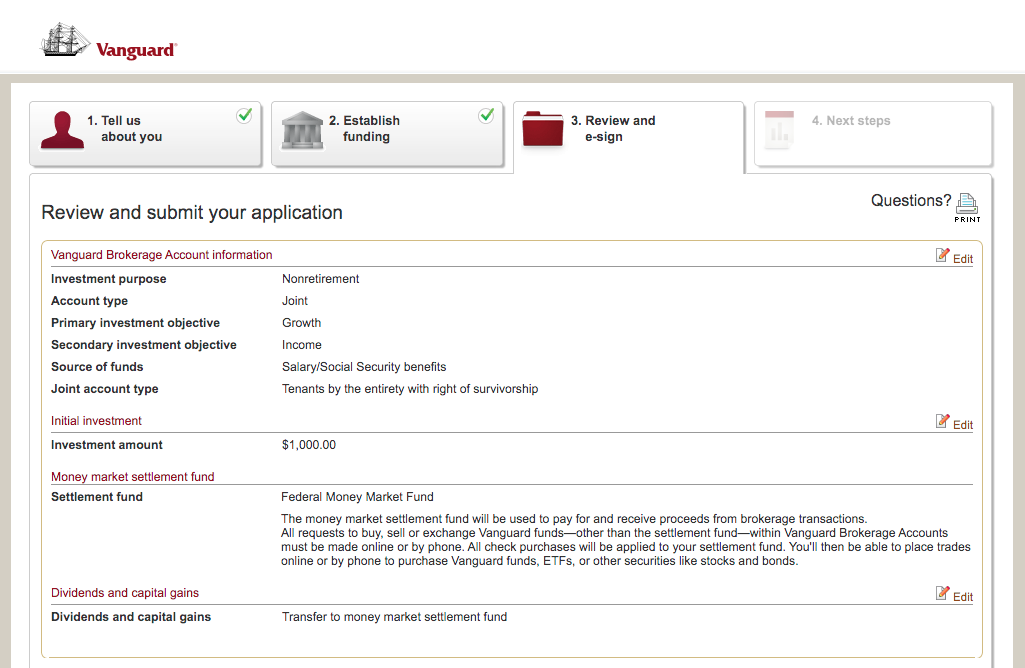

- Next, you review and submit your application for the new account.

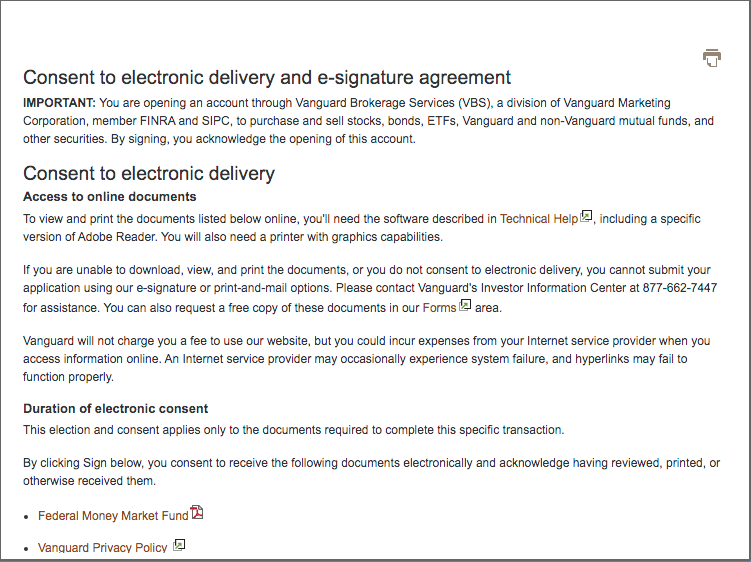

- You consent to electronic delivery and e-signature.

- It then gives you an account number.

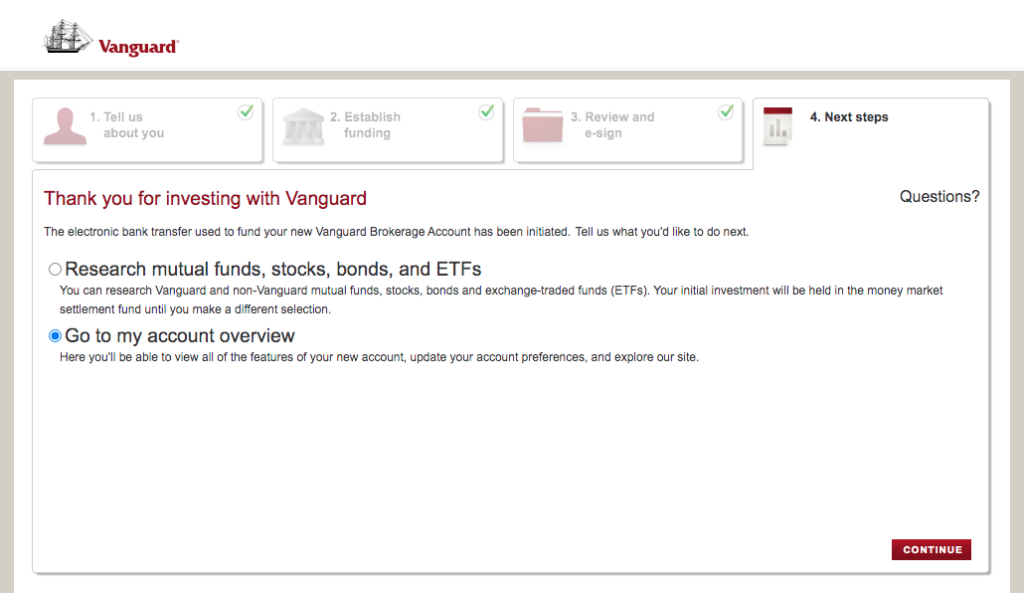

Investing In Your Taxable Account

Now you get to pick your investments that you want to put the money in.

- This may take a few days if you are new to the system, until your bank account is linked.

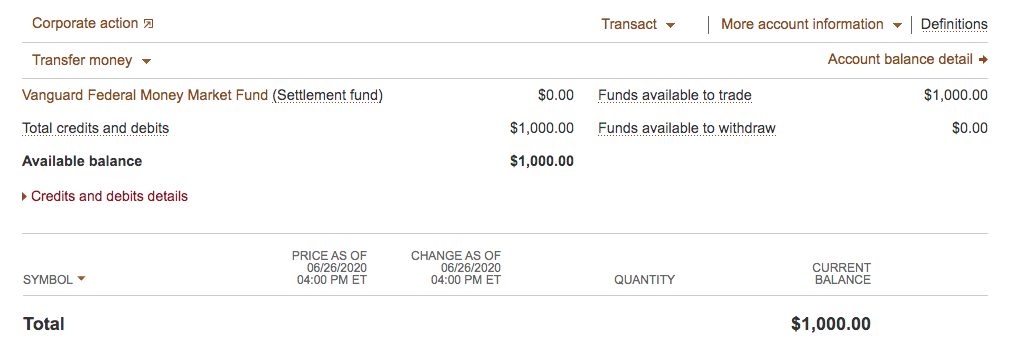

- Account overview shows you a list of all your accounts.

- Under account overview, your brokerage account shows up like this:

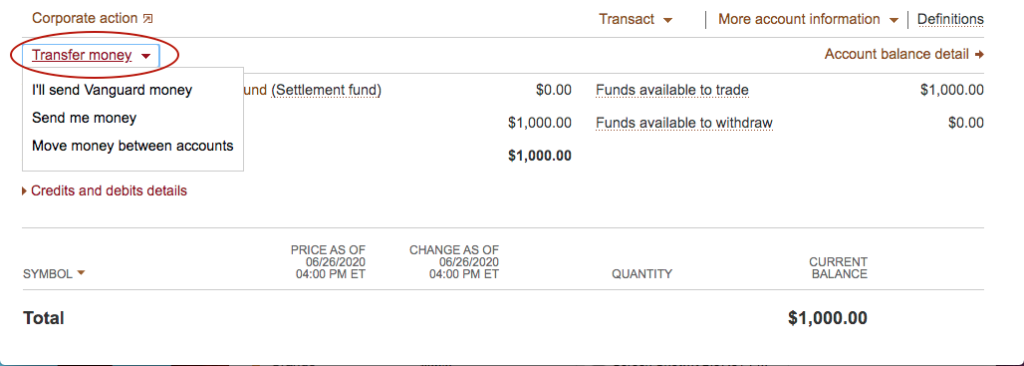

- If you have not yet funded your account, you can do it right here. “I’ll send Vanguard money” is the option to transfer funds from your external bank account to your Vanguard brokerage account.

- That money then sits in cash in the settlement fund, until you put it in a specific investment.

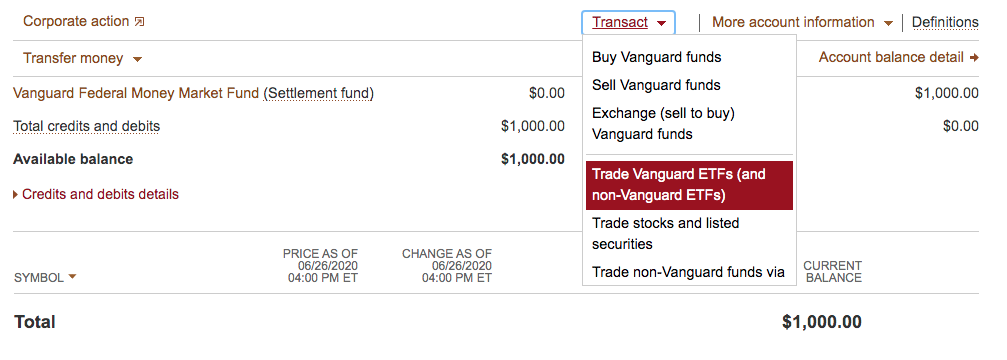

- To buy an investment, go to the “Transact” tab. It gives you options to buy/sell mutual funds, ETFs and individual stocks.

- I’m in the ETF camp- so let’s see how that’s done.

How To Buy an ETF in Your Taxable Account

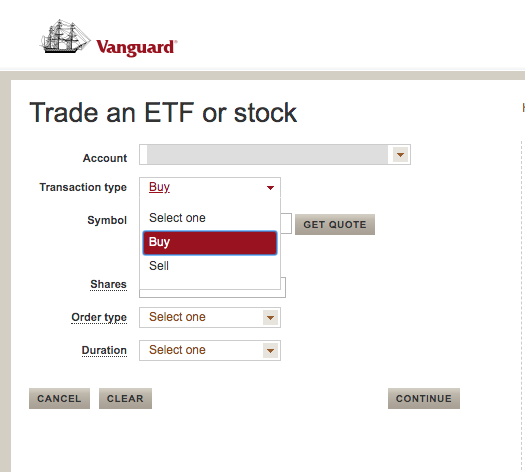

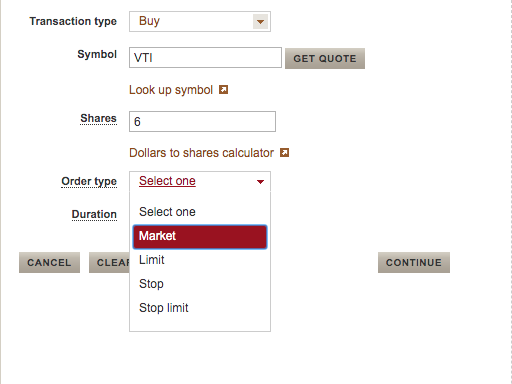

- Clicking on “Trade Vanguard ETFs” as above takes you to the following screen.

- Make sure you’re in the right account.

- Select Buy.

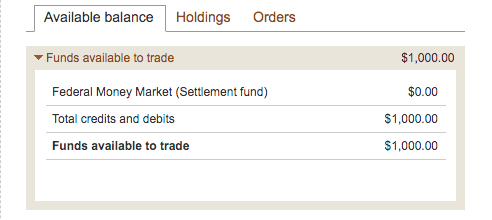

- Another part of the screen shows you how much funds you have available to trade.

- With a linked bank account, funds are available immediately to trade, but not to withdraw (obviously).

Bid Ask Spread

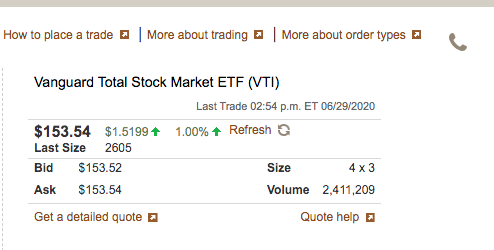

- Next comes the ETF you want to buy. As soon as you type in the name, the quote comes up. VTI: Vanguard Total Stock Market ETF, in this example.

- It shows the current price and then the Bid and Ask prices.

- Bid price is how much you’ll likely receive when you sell.

- Ask price is how much you’ll pay to buy the same investment.

- As you can see, the Ask price is a tad more than the Bid price.

- For ETFs that are transacted in high volume- like this Vanguard Total Stock Market ETF (the Volume of trading is noted on the right), the Bid-Ask spread (the difference between these two prices) is low- only $0.02 here.

- Since I’m a buy-and-hold investor, not a frequent trader, this small difference does not bother me.

- You should know, however, that this is specific to ETFs. Mutual funds don’t have this issue. And in fact, mutual fund proponents like to tout this as a major drawback of ETFs.

- But, for ETFs with millions of trades every second, the spread is usually small. Just take a look at it when you’re trading ETFs.

- Also, in the first and last hours of the trading day (9:30 am to 4 pm), volume may be lower and hence, spreads higher.

- It asks how many shares of the ETF you’re buying. I use the Dollars to Shares Calculator.

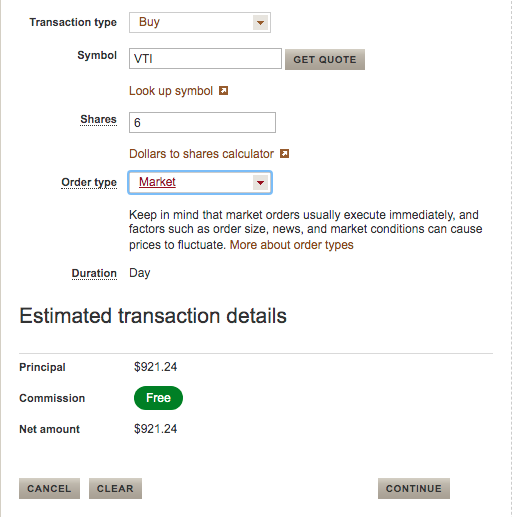

- Order type: I usually do market orders, but many people do only limit orders and that’s fine, too.

- I always look at my purchase price before hitting submit to make sure I’m not paying something weirdly high.

- It gives you the estimated Transaction below.

- Since Vanguard doesn’t allow sale of fractional ETFs/mutual funds, you will have some money left over.

- That extra will sit in your Settlement fund until you invest it elsewhere.

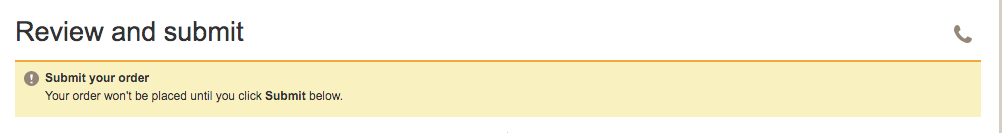

- Always review before submitting.

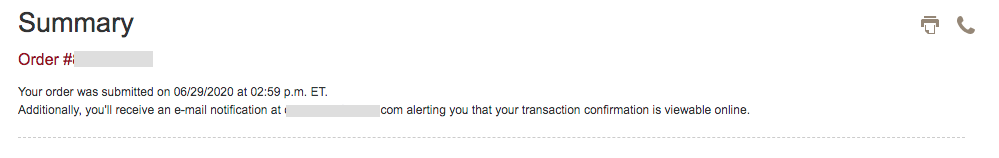

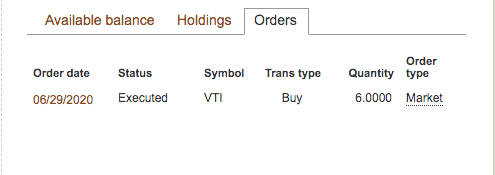

- When your order goes through, which is immediately for Market orders, you get an order number and subsequently a confirmation email.

- Order Status now says executed.

- If you want to make another trade, or look at the Fund prospectus, you can do that on the same screen.

- You’re done!

- Be sure to log off and close your browser.

I hope this is useful as you open a taxable account and start ramping up those savings!

Thank you for reading. Post your questions and comments below.