We started our conversation on Healthcare Costs in Retirement in Part 1 and here we will continue to look a little closer at the numbers.

Healthcare Costs in Retirement: The Sum Total

We saw the results of the Fidelity and HVS Financial Studies,which respectively, estimated that a couple turning 65 yrs in 2019 will spend $285,000 and $394,000 throughout retirement on healthcare related costs.

Average doesn’t mean much. No pun intended.

This average number of $285,000 for a 65 yr old couple is just that- a nationwide average. The ranges are so wide, depending on a number of factors, that you need to understand how they affect you:

1) Chronic Conditions

The presence of known or expected chronic conditions due to personal or family history dramatically change your health expenses. The Vanguard/Mercer analysis breaks down retirees into 3 tiers: low, medium and high risk of incurring greater healthcare costs.

High risk individuals are smokers, have 2 or more of the commonest chronic conditions and see the doctor frequently.

For a 65yr old woman retiring in 2018, if she were low risk, her median annual healthcare cost would be $3400. If medium-risk: $3600 and if high risk: $7600. What may be even more significant is that the confidence intervals widens greatly for higher risk individuals: the 90th percentile for the high-risk group is way up at $21,000 annually.

2) Longevity

Longevity affects the number of years of healthcare requirement

3) Annual income in retirement

Medicare Parts B and D premium surcharges apply to income >$170,000 for a married couple. This does not get adjusted for inflation with time- a clever cost-cutting measure by Congress.

Steps to minimize the effect of Retirement Income

- Distributions from Roth IRA and HSA do not factor into the income considered for surcharges.

Build up your Roth (through the Backdoor, if you have to) during your peak income years.

Roth-convert in the years leading up to and in the first few years of retirement, particularly before Medicare eligibility.

- Distributions from Traditional IRAs do count. Deductible healthcare expenses may offset a small part of it.

- Diversify retirement income so that at least some of your annual expenses come from investments that are taxed at long-term capital gains, rather than ordinary income tax.

4) Geography

Medicare Part B premiums are the same nationwide but Part D premiums, Medicare Advantage/supplemental Plan premiums vary.

5) Supplemental Plans

Even though it adds another set of premiums, it usually brings down OOP max. Therefore making your healthcare budget more predictable.

For e.g., in the Vanguard Mercer study, for a high-risk patient without a supplemental plan, the annual cost can vary from $3500 (10th percentile) to $21,800 (90th percentile). With a Supplemental Plan, it narrows down the range from $5500-$11000 (10-90th percentiles).

Healthcare Inflation

The costs of healthcare have been rising incessantly. They are expected to outpace general inflation and Social Security cost of living adjustments (COLA). Most of this is driven by increase in prescription drug costs.

Healthcare inflation has slowed in the last couple of years but is hard to predict with any degree of accuracy over the longer term.

Apart from that, healthcare utilization also generally increases with age.

Both combined, you can expect to need more towards the end of retirement than at the beginning. The 2018 HealthViewServices analysis estimates double at age 75 (nearly $20k) and triple by age 85 (nearly $32k) compared to age 65 (nearly $12k/yr).

This is however, more than made up by the decrease in discretionary spending in the later years of retirement.

Reframing “Healthcare Costs in Retirement”

In recent years, there has been a shift, and for good reason, in the discussion of healthcare costs in retirement. Instead of looking at a large scary lump sum, look at it as another item in the annual budget.

This is because healthcare expenses are not needed as a lump sum at any one point in time. It is an ongoing, recurring cost throughout retirement. Just like housing or transportation or food.

Looking at this way, an average female turning 65 in 2018 is estimated to spend $5200/yr on average throughout retirement on all things healthcare, most of it on premiums (for Parts B, D and Supplemental coverage) as per the Vanguard/Mercer Study. HVS Financial’s estimate for a 65 yo male in 2019 is $4500 a year.

Looking (far) into the Future

What if you are not looking to retire today or even year but in a decade or two?

The same HVS analysis estimates that a couple who is 55 yo now will spend almost $388,000 in retirement healthcare costs and one who is 45 yo now will spend nearly $415,000.

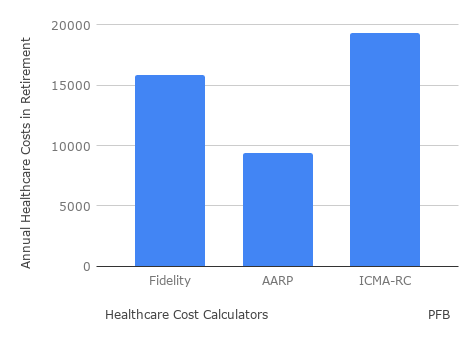

There are some new calculators to help estimate Healthcare Costs in retirement. Here are some of them:

- Fidelity Healthcare Cost Estimator

- AARP Health Care Costs Calculator

- ICMA-RC Retiree Health Cost Estimator

- HealthView Financial Healthcare Cost Projector

They generally include the total cost of healthcare- as a lump sum throughout the period of retirement- based on current age and let you input various details, which are different for the different calculators.

Healthcare Costs for a 40 year old Couple

I ran the calculators for a couple where both are 40 yrs old, healthy, expect to retire at 65 and expect to live 87 (male) and 89 yrs (female)- to compare costs for someone not expecting to retire for another couple of decades. The results have a wide variation which tells us the degree of uncertainty in this regard. Also, the underlying assumptions are different, the personalization data you can input differ and also what the estimate includes.

Fidelity Healthcare Cost Estimator

The Fidelity calculator is simple. It only includes age, gender, retirement age and life expectancy. It estimates this couple will need about $365,000 in retirement to meet healthcare costs. Or $16,000 a year. It includes premiums for Medicare Parts B and D and out-of-pockets costs for Parts A, B and D. It assumes 4.9% annual rise in healthcare costs.

AARP Health Care Costs Calculator

The AARP calculator is the most comprehensive. It lets you include some important aspects of your personal and family health history. The calculator also takes into account where you will retire to further personalize premiums for Part D. It spits out the estimated total healthcare dollars this couple will incur (~$643,500) and how much of it Medicare will pay for (~$428,400). The difference is what this couple is on the hook for ($215,000). Annualized cost: $9350. I suspect this estimate is the lowest since it gathers the most data- and I input no adverse health history for this exercise.

ICMA Retiree Health Cost Estimator

ICMA calculator is similar but less detailed. I found its estimate significantly higher than the AARP calculator ($1.28M total HC cost, ~$833k Medicare coverage, ~$444k personal expense), at least partly since it assumes Healthcare inflation of 8.8%.

These above estimates generally include the premiums for Medicare parts B and D, cost-sharing (copays, deductibles) and average out of pocket expenses. They do not include any Supplemental coverage, dental/vision/eye care expenses or the cost of long term care.

HealthView Services Health Cost Projector

HealthView Advisor Healthcare Cost Projector tells you what to expect to pay for premiums for Medicare Parts B and D. It additionally asks for annual income in retirement to account for premium surcharges. It is also different from the other calculators in that it states the projection in Future dollars (~$1.8M future dollars for the 40 yo couple. Their assumption for conversion to FV is not specified). Your report is then emailed to you. Just uncheck the boxes to be contacted by an advisor, if you so choose.

I did round up the numbers above to the nearest $1000 to make it easier to read.

Long Term Care: a Whole Different Story

LTC includes a range of services- from adult day care, assisted-living facilities, home health services to Nursing home care. LTC is not included in either the Vanguard or Fidelity surveys. Or the individualized cost calculators. This is because the potential costs vary all the way from zero to hundreds of thousands.

As per the Vanguard study, nearly half of all retirees do not incur any LTC cost at all; 25% incur some- averaging $100,000 and 15% of retirees spend an enormous amount, more than $250,000.

Medicare does not pay for a prolonged duration of LTC and usually neither does private insurance plans. It only covers about 3 months post-hospitalization. About 1 in 3 people needing LTC rely on Medicaid, most spend out of pocket.

The general premise is to spend down remaining assets and then go on Medicaid, if needed. Your home is generally protected from Medicaid recovery while your spouse is living in it.

We hope some viable insurance solutions to LTC will come up in the near future. The costs for such insurance have lately been prohibitive due to the high cost of LTC itself. Maybe more limited insurance could play a part- high deductibles, longer waiting periods (in months to years) prior to insurance kicking in. We’ll have to wait and see.

With this, we come to an end on the discussion of Healthcare Cost in Retirement. Does this topic keep you up at night? What do you think of the estimates made by these calculators? Let me know in the comments! Thank you for reading.